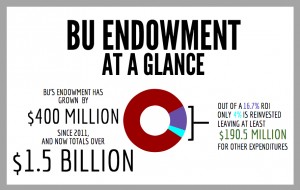

Boston University garnered a 16.7 percent return on their over $1.5 billion endowment for the 2014 fiscal year, about 4 percent of which BU will reinvest to generate additional funding in the future.

BU manages its endowment through Chief Investment Officer Clarissa Hunnewell, who uses the endowment to invest in stable assets, such as stocks and bonds, to produce a strong return, said BU spokesman Colin Riley.

“It really reflects the strong investment management by our chief investment officer,” Riley said. “This is a solid return, and it reflects the market and how strong the economy is.”

Though BU saw a growth in its endowment of 16.7 percent, the university will continue to invest a majority of the funds as opposed to spending the profit on the school immediately, Riley said.

“Not all of the increase is spent,” he said. “Only a small portion of it is, and about 2 or 3 percent goes to the operating budget and helps with operating costs.”

Daniele Paserman, a professor of economics in BU, said an endowment serves as the university’s “nest egg” for the future.

“Just like any household, BU invests its nest egg in a combination of assets – cash, certificates of deposits, stocks, bonds, etc., which yield returns,” Paserman said in an email. “The ROI is simply the return on that investment. If last year’s ROI was 16.7 percent, it means that BU’s nest egg today is 16.7 percent larger than last year. That’s clearly good news. The university has more income.”

The high return is a reflection of the stock market rise during fiscal year 2014, Paserman said.

“The S&P [Standard and Poor’s] 500 between July 1, 2013 and June 30, 2014 went up by 20 percent,” he said. “It’s likely that holding a balanced portfolio of stocks and other assets was enough for BU to generate such a nice return.”

Paserman said the remainder of the endowment that will not be reinvested would help ensure BU’s financial security in the future.

“It sounds as if BU has a guideline to spend 4 percent of its endowment,” he said. “This means that the extra income is likely reinvested, so that BU will have money to spend, even in years in which the stock market doesn’t do as well.”

Several BU students said there are a number of different areas they would like to see the money reinvested.

CAS junior Elias Condakes said BU should appropriate a majority of its funding to helping students pay for school.

“I’m a huge fan of money being allocated to student activities, but to scholarships and financial aid packages first and foremost,” he said.

Jessica McAloon a freshman in CAS, said the money should be reinvested in resources that BU students would benefit from.

“BU should invest in more teaching assistants and more office hours so students can get more attention,” she said.

Marina Selak, a senior in the College of Communication, said BU should invest in more up-to-date technology.

“The money should go to projectors and stuff for class, electrical stuff like computers and resources for students,” she said. “I don’t really think BU is doing a good job as compared to Emerson [College]. They have a lot of resources for their students, like better computers.”

Samantha Gross contributed to the reporting of this article.