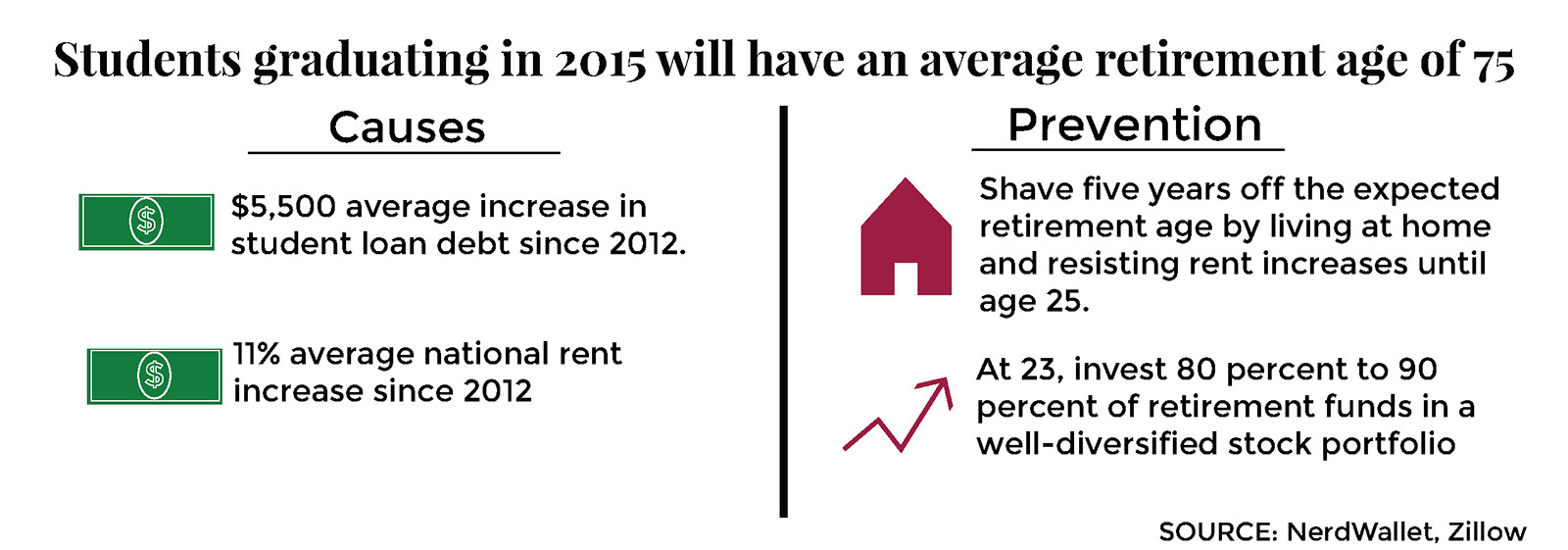

Students graduating in 2015 will have an average retirement age of 75 due to the increasing costs of living and student debt, according to a study published Wednesday by NerdWallet.

NerdWallet, a personal finance website geared towards educating millennials in financial decisions, found that today’s college graduates will have to work 13 years longer compared to today’s retirees, who are leaving the workforce at 62 on average. NerdWallet also published a study of average retirement age for graduates in 2013, which was 73.

NerdWallet’s 2015 New Grad Retirement Report found that factors such as student loan debt and increases in average rent keep millennials from saving for retirement. Average student loan debt has increased by more than $5,500 since 2012, from $29,400 to $35,051.

The report also cited research from Zillow, which showed that rents have increased 11 percent nationally since 2012.

All in all, millennials graduating in 2015 will need a $ 1.189 million nest egg for nine years of retirement, the study stated.

Arielle O’Shea, an investment writer for NerdWallet and the author of NerdWallet’s 2015 New Grad Retirement Report, said NerdWallet has been tracking data on millennials’ retirement since 2013.

“We’ve looked at this data before and wanted to build on previous studies to check in on how things have changed for millennials,” she said. “It turns out, all these factors have a huge effect on the ability to save for retirement, and they are still changing.”

O’Shea said these studies aim to educate current students and recent graduates on their financial futures.

“The purpose of the study was to get a handle in real terms of how the student loans debt crisis is affecting students and their futures,” she said. “We figure not many students think seriously about retirement, so this can get them started.”

O’Shea said NerdWallet will continue to track millennials’ changing financial futures.

“We will check in with the data to see how things change. Hopefully that number will go down,” she said. “Hopefully students and graduates follow as new data comes out, so they can use it to their advantage.”

Boston University spokesman Colin Riley said this data could be a tool for students to start thinking about building financial security as soon as possible.

“[The data] looks like it is framed in a way to urge young people to start saving for their retirement, which is very good advice especially if you’re able to start early,” said Riley. “As soon as you graduate and are employed, the sooner you can start a retirement plan.”

Aside from the number of factors the study found to negatively impact millennials’ ability to save for retirement, it also offered specific actions to support saving and decrease age of retirement.

Keeping cost of living low is key for accumulating savings earlier, the study found. New graduates who live at home and are resistant to rent increases until age 25 shave five years off the expected retirement age of 75.

One common characteristic across the millennial generation is a hesitance to invest personal savings, a mistake potentially costing $300,000 in investment returns, according to the report.

“Most experts would suggest that a 23-year-old invest 80 percent to 90 percent of retirement funds in a well-diversified stock portfolio,” the report said.

The report advises millennials to prioritize making diverse investments and planning with the help of a financial advisor while saving for retirement.

Several BU students, however, said learning about and making the smallest changes in millennial saving patterns are what will make the most difference in their future financial situations.

Hallie Coyne, a freshman in the College of Arts and Sciences, said awareness among students is valuable, and they should know enough to be prepared for future financial trends.

“Everyone should be aware of statistics like these, but not rely just on them. I think with long-term planning there is also a lot of room for change in financial markets or policies,” she said. “College students should be most aware and start saving, especially because this is basically our last stop before the real world.”

Yuekun Liu, a sophomore in CAS, said that although the student debt crisis is a highly publicized issue, students should know what debt means to them in the near future.

“It’s important people are aware that saving is a very real issue,” he said. “All you hear on the news is how bad student debt is but students should be thinking what they can do to work against it as soon as possible.”

Rosie Webb, a sophomore in the College of General Studies, said students should be conscious of the problems awaiting them after graduation, and take action regarding their finances in whatever ways they can.

“I think there are things the government could be doing about education costs and debt, but students should be thinking about their finances early on,” she said. “Start making small changes here and there and start saving early, so hopefully it’s not as big of a problem later on.”

Luckily things don’t appear quite as grim as the original article suggests, here’s a counter view: http://retirementrocketscience.com/good-news-class-of-2015-you-wont-have-to-wait-until-age-75-to-retire/