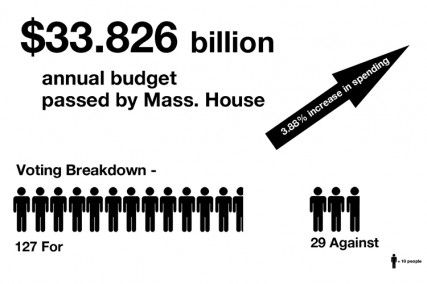

The Massachusetts House of Representatives passed a $34-billion budget for the 2014 fiscal year Wednesday after three days of extended deliberation.

Every House Republican voted against the fiscal budget, but the final vote stood at 127 to 29. The Senate is likely to pass a version of this budget in May of this year, before it goes to Mass. Gov. Deval Patrick’s desk.

Brian Dempsey, chairman of the Committee on Ways and Means, wrote a letter attached to the budget, outlining the financial details.

“This budget is a fiscally responsible proposal that includes a 3.88-percent increase in spending, slightly below the projected consensus revenue number,” he wrote in the letter on Wednesday.

While the Republican Party failed to halt passage of the budget, House Minority Leader Bradley Jones, a Republican from North Reading, said the budget was fiscally irresponsible.

“Unfortunately, as adopted, the budget demonstrates the House Democrats’ continued willingness to rely on revenue found in the recently passed transportation finance bill,” he said. “While the taxpayers of Massachusetts have avoided the enormity of Gov. Patrick’s $1.9-billion dollar tax hike, our state’s residents should find no comfort in the $500-million dollar tax increase approved by my colleagues across the aisle.”

Rep. John Keenan, of Salem, said this year’s budget is very different from the budget proposed by Patrick in January.

“It’s quite different if you look at them together. We had to talk about transportation and the governor proposed a tax in his budget, but we did the transportation stuff separately a couple of weeks ago and then we did this budget,” Keenan, a Democrat, said. “He had raised the income tax and lowered the sales tax, we didn’t do that. We did the gas tax and a few other things to be able to fully going forward with the transportation issue.”

Keenan said that although he had not spoken to House Republicans about the issue, his sense was that they were opposed to the tax increases proposed in the budget.

“Coming into the budget, they were of the position that they were not going to vote for the budget because it had to raise maybe about a half a million dollars in taxes, the gas tax and a few other things,” Keenan said.

Rep. Peter Durant, of Spencer, said the reason he voted against the budget was his stance against on tax increases, citing that there is a better plan to pay for the transportation spending of the Commonwealth.

“We came up with a very real plan to accomplish our goal without increasing taxes,” Durant said. “We had a plan of a 1 percent across-the-board cut in discretionary spending. With that one percent cut we would have been able to accomplish is to take the big dig debt off of transportation, and that 1 percent would have been able to pay for that debt in an ongoing basis.”

Sambuddha Ghosh, professor of economics at Boston University, said the increase on the gasoline tax in certain areas could lead to more people utilizing public transportation.

“The points worth noting are increased proposed spending on higher education, but less total spending on education than the Governor wanted — and the 3 cents increase in gasoline tax,” Ghosh said. “I do think that regions with better public transportation should have a higher tax on fuel to give incentives to people to use public transport except when it is much worse than driving. Done properly, this could raise revenues and make our public system more efficient.”

Once the Senate votes on their version of the budget, a conference will be convened and the combined budget will be presented to Patrick, Keenan said.

“So they’ll [the Senate] will come out with a final budget like we did, and a conference will be in place, the House and Senate will come up with a conference committee budget proposal that we will vote on and then send that to the governor,” he said. “All done we will try and have a budget in place by July 1.”