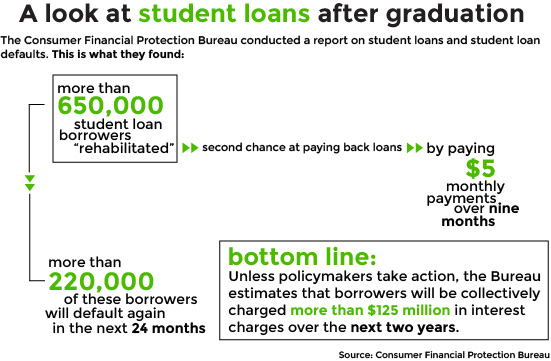

Approximately 30 percent borrowers who defaulted on their student loans last year are expected to default on their loans again in the next two years, unless authorities do not take necessary action, according to a Consumer Financial Protection Bureau report released Monday.

The report analyzed approximately 5,500 private student loan complaints and 2,300 debt collection complaints submitted from September 2015 and August 2016. In its final six months of analysis, the Bureau also handled 3,900 complaints related to federal loan servicing.

Under federal law, borrowers who defaulted have a right to cure their default and enroll in an income-driven repayment plan, through which they are required to pay only $5 a month and are allowed a $0 monthly IDR “payment” once they have cured their default, according to the report. This plan essentially protects borrowers from delinquency and default, the report stated.

The report recommended implementing the Department of Education’s July 2016 suggestion by putting together public performance measurements to determine high-risk borrowers’ behavior.

Boston University spokesperson Colin Riley wrote in an email that the findings of this report shouldn’t affect the majority of BU students. Degree completion is a factor in defaulting, he added.

“BU students have an extremely low default rate,” Riley wrote. “It is below 2 percent of borrowers, so it generally doesn’t apply to Boston University student borrowers.”

John Harris, an economics professor in the College of Arts and Sciences, said success is a key factor when it comes to being able to pay off student loans.

“The basic idea is that if you go to school and you have a good degree, your earnings will be higher and that therefore you can afford to pay back part of the costs that were incurred,” Harris said. “The argument is that it’s probably fair that people who gain the benefits also pay part of the cost.”

Harris said there is a chance that lenders are taking advantage of students.

“The system, particularly the private, for-profit trade schools and colleges, have recruited students who may not be able to benefit from the training or in many cases the actual trainees themselves does not give marketable skills, so there’s been a lot of fraud in this area,” Harris said.

Several students said although they appreciate the option of having student loans, it’s also a heavy burden.

Catherine Nguyen, a sophomore in the College of Engineering, said loans allowed her to have a college education.

“I participate in student loans,” Nguyen said. “Without student loans, I wouldn’t be able to attend BU. Maybe down the line, with hindsight, loans might be a bad idea. But currently, that was the only way I could handle attending BU.”

Zachary Thorpe, a senior in the College of Communication, said that as a senior, the weight of paying off loans is a large problem.

“The sheer amount of student loan is certainly a hindrance on mental health,” Thorpe said. “Nowadays it’s a real weight on students. It’s just the biggest pressure, more than getting a job or profession.”

Zoe Huang, a CAS sophomore, said she doesn’t know many people who have taken out loans.

“I have one friend; she’s just too lazy to deal with them,” Huang said. “And a lot of my other friends are here on scholarship so they don’t have to take out loans.”