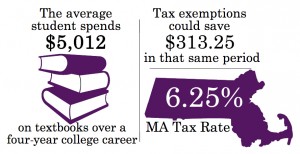

Boston University students may be overpaying for their textbooks due to an unacknowledged fact that in Massachusetts, books required for college courses are tax-exempt.

In order to raise awareness of the tax-break, which is offered in several states, economic advisory website ValuePenguin compiled a comprehensive guide for college students that explains step-by-step how to file for tax exemptions on required textbooks.

“This exemption benefits students by allowing them to reclaim taxes that they probably overpaid,” said ValuePenguin’s Ting Pen. “Few people are aware of this because the exemption is a bit arcane – it’s buried in the Massachusetts Department of Revenue tax code, which people don’t usually read.”

The College Board estimates that students currently enrolled in higher education institutions spend about $1,253 on textbooks at four-year, private institutions such as BU. If Massachusetts college students took advantage of tax-exemptions provided for required course materials, they could save approximately $78 a year, or $313 over the course of four years at a university.

“Every dollar counts for a college student,” Pen said. “With the school year just beginning, we started researching helpful information for undergraduates to save money on their studies…We published the state guide to textbook exemptions so that students could actually save money that they shouldn’t have to pay.”

In order to file for a tax exemption, students have to fill out an ST-8 Sales Tax Exempt Certificate for Books Used for Instructional Purposes, accessible through ValuePenguin’s guide, for each textbook they are purchasing. They may then present it to the vendor in-store or submit it to an online vendor electronically.

For students who purchased textbooks before learning about the state-level tax breaks, the Massachusetts Department of Revenue Individual Use Tax Return form is also available on ValuePenguin’s site.

Both Barnes & Noble and Amazon have outlined procedures for filing for tax exemptions for books purchased online, which entail providing student identification, class syllabi and tax exemption numbers.

Several Boston University students said they were unaware tax-breaks for required textbooks existed in Massachusetts.

“It’s crazy that no one really knows about it and they don’t really advertise it, because college costs so much, and you don’t really realize how much you are going to spend each semester,” said Maria Tata, a freshman in the College of Arts and Sciences. “It is nice to know that you can get some money back so you can use that money to buy your other books next semester.”

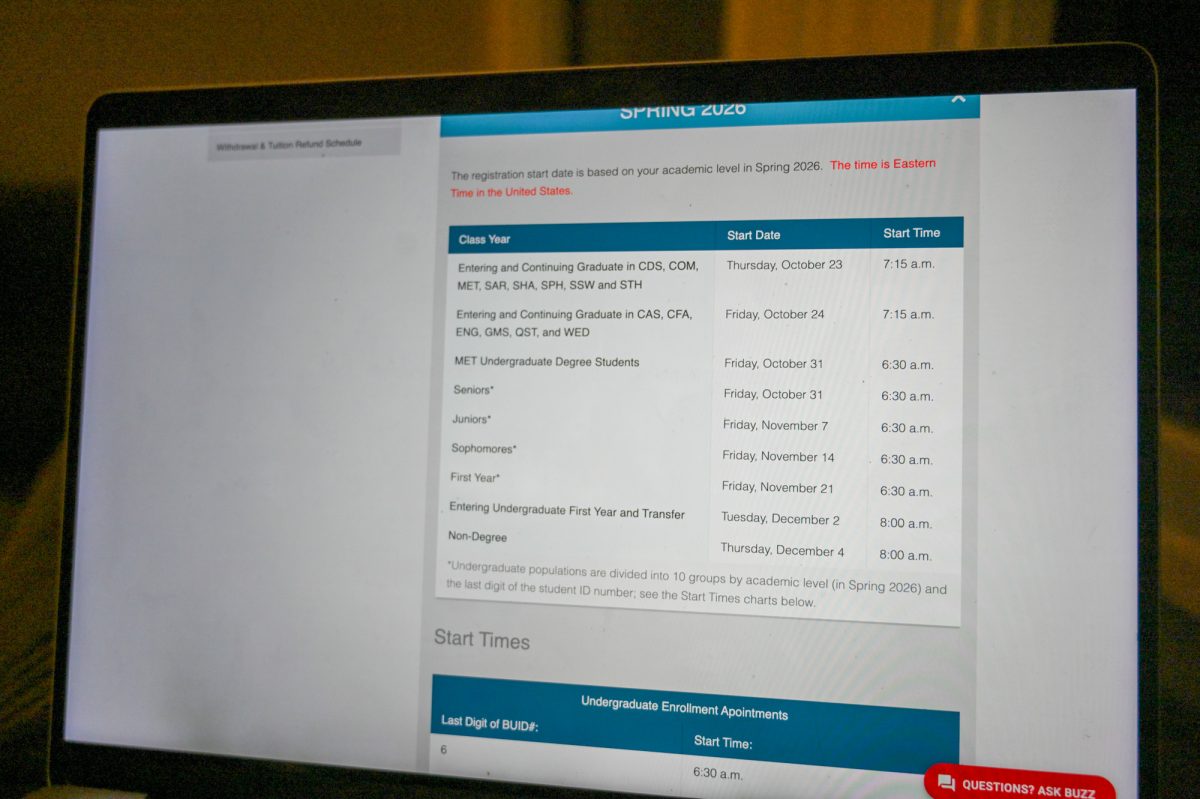

Claire Kinton, a first year graduate student in the Metropolitan College, said she does not know if taking the time to fill out tax exemption paperwork would be worthwhile, depending on the initial cost a student incurs on course materials.

“My textbooks this semester weren’t really that expensive,” she said. “If I had a few really expensive books, I would go through the trouble of filing for an exemption, but if it was just $20, then I wouldn’t bother.”

Neil Mgaieth, a sophomore in CAS, said the exemptions would be particularly beneficial to international students, a population ineligible for federal grants and BU-based scholarships.

“We spend so much money on buying textbooks, and they are so expensive,” he said. “On top of that, we are paying $60,000 for a year, so getting a tax exemption would be great.”

CAS senior Monideep Chakraborti said tax exemptions are an especially important resource for BU students.

“It’s a good thing for students to have a tax exemption because we pay so much for the books,” he said. “Any college student who knows about this should take as much advantage as they can. It would be really helpful financially because saving money is always a good thing.”