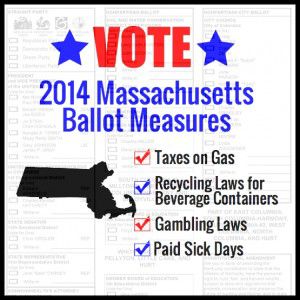

With the general election fast approaching on Nov. 4, Massachusetts residents will vote for a new governor, but they will also have the opportunity to vote on four initiatives that will appear on the ballot and could change or alter existing laws in the Commonwealth.

Of the measures that qualified for the ballot, Question 1 could repeal a 2013 law that automatically increases gas taxes according to inflation, Question 2 could expand the Commonwealth’s beverage container recycling law to include all non-alcoholic containers, Question 3 could repeal a 2011 law allowing resort casinos and Question 4 could entitle certain employees to earn and utilize paid sick days.

After the Attorney General decides if a proposed petition is a proper question that can be put to referendum, the petitioners must go out and gather signatures from the public, said Brian McNiff, spokesman for Massachusetts Secretary of State William Galvin’s office.

“The number of signatures they have to get changes every four years,” he said. “Last year, they had to get 68,911 signatures, and they also were limited to no more than a quarter [25 percent] from any one county.”

McNiff said petitions are usually not initially approved by the Legislature after they review the signatures, so sponsors of the petition need to get more signatures over the summer, which is what happened with the four questions on the 2014 ballot.

“This summer, they had to go get 11,485 more signatures,” he said. “Those four petitions came in with the necessary signatures, and now they are on the ballot.”

Question 1

If approved by voters, the measure would repeal a 2013 law that ties gas tax increases to inflation, allowing for automatic annual increases in the Commonwealth’s gas tax.

Tank the Gas Tax deemed the tax a slippery slope, saying, “If we don’t stop the linkage of this tax to inflation, then the legislature will surely link other taxes to inflation,” according to their website.

Massachusetts Gov. Deval Patrick opposes the initiative. In Dec. 4, 2013 article, he told South Coast Today, “I think those that are advocating that the indexing be undone need to answer for why it is they keep showing up for all the ribbon-cuttings every time there’s a new bridge or a new road project done, but don’t seem to want to participate in how to pay for it.”

Question 2

Phillip Sego, coordinator of the Bottle Bill campaign for the Massachusetts Sierra club, said people are starting to consume and produce more waste which is why updating the Bottle Bill is essential.

“The current coverage of the Bottle Bill is just soda and beer, and when it was passed 30 years ago, people didn’t drink water, or juice, or Gatorade or other sports drinks,” he said. “What’s happened over the last 30 years is that consumer tastes have changed, and the litter rate has increased.”

Sego said if the Bottle Bill were updated, recycling rates in Massachusetts would increase for all types of containers.

“The beverages that are covered right now are recycled 80 percent of the time, which is phenomenal,” he said. “The ones that are not covered are only retained 23 percent of the time. The rest become either litter or trash. As soon as this passes or goes into effect on Earth Day next year, that same incredibly high recycling rate will be extended to all beverages, whether they are carbonated or not.”

Nicole Giambusso, spokeswoman for No On Question 2: Stop Forced Deposits, said updating the Bottle Bill is too costly.

“One of our main concerns about Question 2 is that it costs too much and does too little,” she said. “Question 2 will add nearly $60 million a year to the cost of groceries, and it will only increase recycling by one-eighth of a percent. A fraction of a percent is not worth families having to pay more at the checkout counter.”

Giambusso said there are other solutions to the recycling problem besides updating the Bottle Bill.

“Instead of spending tens of millions in consumer money to add to an outdated, inefficient system, we should build on single stream, curbside recycling programs that work today,” she said. “No On Question 2 wants to see cleaner streets and higher recycling rates, but Question 2 is not the answer.”

Question 3

The costs of operating casinos in Massachusetts outweigh the benefits the resort casinos could bring to the area, said Stephen Eisele, spokesman for Repeal the Casino Deal.

“The casino gambling bill has a variety of costs and benefits associated with the opening of casinos across the state,” he said. “We believe that the casino industry is oversaturated and in a period of volatility, evidenced by the closing of four casinos in Atlantic City this year and revenues down in Connecticut, Delaware and elsewhere.”

The Coalition to Protect Mass. Jobs claims operating resort casinos will create “10,000 high-quality, permanent jobs and 6,500 construction jobs…that offer solid wages and real benefits,” according to their website.

Eisele said casino gambling would take revenue away from the state lottery, resulting in cuts to local aid for several cities and towns.

“Additionally, casinos have a number of negative consequences, which explain the need for mitigation agreements for host and surrounding communities,” he said. “Rates of crime, drunk driving and domestic violence have all been seen to increase with the introduction of casinos to a community.”

The Coalition also claims that casinos are not associated with general increases in crime rates, citing several studies from Harvard University and Temple University that conclude that crime rates do not rise with the introduction of a casino, according to their site.

Question 4

Debra Fastino, executive director of the Coalition for Social Justice, said the Earned Paid Sick Time Act would benefit the nearly 1 million workers in Massachusetts who cannot afford to take a paid sick-day off.

“Hardworking people shouldn’t have to choose between the job they need and the children they love,” she said. “They deserve to be able to go see a doctor without having to worry about being fired.”

Bill Vernon, director of the National Federation of Independent Business, said the law would ultimately harm small businesses.

“This is going to cost companies money, and it is going to come out of something,” he said. “It’s either going to come out of pay, it’s going to come out of vacation time, it’s going to come out of health care, it’s going to come out of retirement. I would contend that most workers would put all of those four things ahead of sick time. Those are more important to workers than sick time.”

For more information on the questions that will appear on the ballot on Nov. 4, check the Secretary of State’s website.