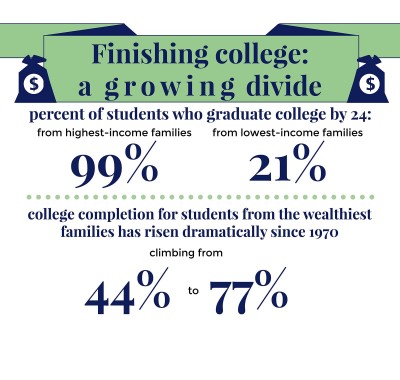

The gap between high-income and low-income students earning bachelor’s degrees has widened over the last 40 years, according to a Tuesday study by the Pell Institute.

The study, titled “Indicators of Higher Education Equity in the United States,” focused on differences in family income to report the status of higher education, identity changes over time and identify policies that promote progress.

“We wished to focus attention on the serious equity issues in higher education in the hopes that it will spark creative thought and action on how to address the issues,” said Margaret Cahalan, one of the lead authors of the report and director of the Pell Institute.

About 81 percent of students who come from families in the top income quartile completed college in 2012, compared to 45 percent of students from families in the bottom income quartile, the report stated.

Cahalan said a goal of the study was to bring to light the growing equity issues in the United States.

“As a nation, the inequality of opportunity and class-based limits on education chances for many of our youth — and lack of public investment in higher education that has taken place in the last 45 years — has led to a situation in which many other countries have now moved forward and the U.S. is not moving forward in the same manner,” she said in an email.

Bachelor’s degree attainment rates for students whose families are making $34,160 or less remain at 21 percent, similar to the rates of 1970, the report stated. Degree attainment rates have increased from 40 to 70 percent for students whose families make $108,650 or more a year.

Several students said they recognize the growing issue of income disparity for students completing college.

Kate Jamison, a freshman in the College of Arts and Sciences, said the findings were not surprising.

“It doesn’t shock me at all,” she said. “A lot of times, lower income students have to work a lot harder while in college in order to afford it. It makes sense that it might get to be too much for them or their families and they wouldn’t be able to graduate.”

Cameron Barkan, a sophomore in CAS, said the disadvantages are clear for those who struggle financially.

“Even with scholarships and grants, some people will not be able to rise above the burden of debt, no matter their level of education or job found after college,” he said.

Brandon Hairston, a senior in the School of Management, said students who have a higher income usually don’t have to take out as many loans and do not have the added burden of having to support themselves.

“When you have a higher income, you plain and simple have more options ahead of you,” he said. “It doesn’t help that student loan debts increase every year for each student either.”

One way to shrink the gap between students of different income levels is to offer more assistance and opportunities, Hairston said.

“We could make this better by offering more programs or scholarships that allow those who want to go to graduate school to do so,” he said. “There needs to be more of a push to continue your degree past your bachelor’s, especially since a bachelor’s is becoming the equivalent of a high school diploma in today’s society.”