So Trump … yawn … released a new tax plan … yawn. He thinks it’s going to help the middle class … and stuff …*eyes close and head falls on keyboard* Huh? What? Alright. I’m awake now.

Tax policy is perhaps one of the most important issues in our modern political climate. But, as you can probably notice from the lack of news coverage, it isn’t very interesting.

There are two main reasons why the new tax plan proposal isn’t getting much media attention. 1.) Our president is juggling Puerto Rico and the dictator who Trump thinks gets intimidated when he refers to him as an Elton John song. And 2.) TAXES ARE BORING. There, I said it again.

I am not going to offer my analysis on the new tax plan. I would spend more time doing math and trying to explain horribly named concepts than actually convincing any of my five weekly readers anything. Instead, what I want to talk about is the attitude we as college students have, and perhaps should have, toward taxes.

The portion of college students that usually care about taxes is comprised of people who own multiple books published by Verso (or even know what Verso is, for that matter), or people who protest in Marsh Plaza or people who get angry when the paycheck from their minimum wage job sends some of their money to a list of acronyms.

At this point in college students lives, we don’t have to worry a lot about taxes. Most of us only encounter taxes through paychecks or sales tax on textbooks, tapestries and (ill-advised) tattoos.

But as your older family members won’t stop reminding you during holiday dinners, “Enjoy this time while it lasts,” and, “The real world is coming!” Side note: From all the accounts I have received about this “real world,” it seems like a horrible Dante’s Inferno-esque place dominated by paranoid, self-centered misanthropes. Maybe making threats about the “real world” is just an excuse used by people who want to act mean but don’t have any justification for their bad behavior. Anyways…

The reason college students should care about tax policy is that regardless what side of the political spectrum you are on, we are perhaps the ones most affected by it.

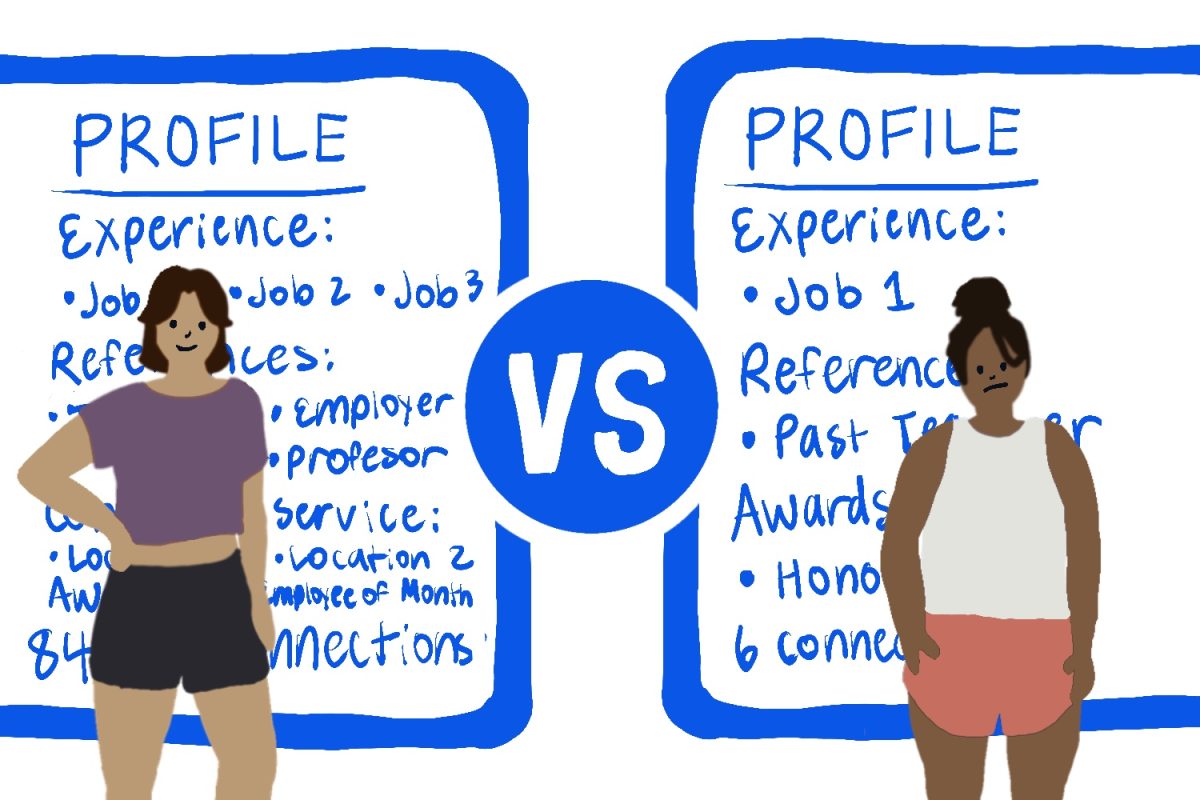

Most of us will be joining the workforce through low to mid income jobs. Tax policy is not currently in our favor. While tax plans always seem to be advertised as skewed in favor of the “middle class,” they are almost all skewed in favor of the rich.

But why favor the rich? Most answers to this question sound something like, “They are innovators, job creators and bolsters of the nation’s economy!” The answer I would give is rather, “No one cares passionately enough about taxes to reform them in favor of the middleclass and poor.” Those who do end up caring are outnumbered by the negatively affected people who believe lie after lie about how the next tax cut is actually going to help them.

This problem of young people’s antipathy towards taxes did not just come about because there is something idyllic about college that allows us to forget the outside world. It is because we have never been taught to care.

Most people listened to Bernie Sander’s ravings about the one percent, but not enough people listened any further to what he was arguing. They took the message and ran with it, hoping no one ever asked them about the logistics. People are also easily swayed by those windbags with megaphones and tricorn hats in the Tea Party saying they want to abolish taxes. Tea Partiers have a long list of things they find “un-American” — such as welfare, equality and rap music.

We don’t like talking about taxes because they are boring, complicated and guaranteed. But we need to start talking about them before we end up losing because of them. I could go on a long rant about the failure of trickle-down-economics or phrases like “allowing innovators to grow” or “taking the trophy away from the winner,” but I don’t want to. Those rants end up alienating people no matter how right they are.

We need to talk about taxes, no matter how taxing it is.