Divestment from fossil fuels could harm university endowments, according to a study published Tuesday by economics consulting firm Compass Lexecon.

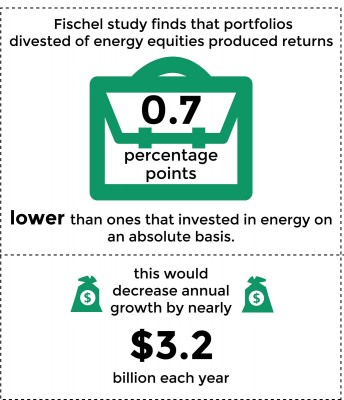

The study, commissioned by the Independent Petroleum Association of America, found that institutions that have divested from the energy equities produced returns 0.7 percentage points lower than ones that invested in fossil fuels, according to a Tuesday press release.

Lead study author Daniel Fischel, a professor of law at the University of Chicago, said in the study that divesting from fossil fuels could have substantial consequences.

“These costs have real financial impacts on the returns generated by an investment portfolio, and therefore, real impacts on the ability of an educational institution to achieve its goals,” he wrote in the study.

Boston University President Robert Brown has forwarded a request to the BU Advisory Council for Socially Responsible Investing, a committee of the Board of Trustees, to review the issue of whether to divest from fossil fuels, said BU spokesman Colin Riley.

“You want to do it in a prudent safe way because that’s what the Trustees and the administration, and the Chief Investment Officer have,” he said. “They have a judiciary responsibility to make sure that that endowment isn’t put at risk.”

Riley said BU has not chosen a stance on divestment because the ACSRI is currently considering the issue.

Claire Richer, a student representative for the ACSRI, said the reasons why BU might divest from something are not as financial as they may seem.

“Those criteria talk more about the social implications of divestment and that divestment isn’t so much about the finances of it, if we’ll lose money or not, it’s more about the social implications and if BU needs to take a stance on that,” said Richer, a senior in College of Arts and Sciences. “That’s more where the focus is.”

Richer said she disagrees with the study because divestment from fossil fuels can be beneficial to a school’s funds.

“The Associated Press actually commissioned a study … and they found that an endowment divested from the top 200 fossil fuel companies would have actually saved money,” she said.

Students for a Just and Stable Future, a group that advocates for BU to stop investing in fossil fuel companies, is part of a larger network called Divest BU that includes students and faculty members, said Rachel Eckles, the vice president of SJSF.

“Right now, BU has 1.5 billion [dollars] invested in all sorts of different companies, and through these investments, they make money for extra tuition and scholarship, and a portion of those investments are in fossil fuel companies,” said Eckles, a sophomore in CAS.

Eckles said SJSF is working to move away from fossil fuel companies and further BU’s sustainability efforts and hopes the Board of Trustees will make a decision about divestment.

“They are willing to divest. They divested from issues in the past, so there is already a criteria set for what they are willing to divest from, but they are still looking to discuss further just how bad fossil fuel industries are and if they [fossil fuels] are causing enough of a social harm to society that we should divest,” she said.

Raising awareness within the student body has been the main goal for Divest BU, Eckles said.

“It’s been definitely a slow start because it [divestment] is all about raising awareness in the student body first, but we have escalated a lot in the last year,” she said. “I’d say BU is a very progressive school and definitely a leader in a lot of things and aiming to be a leader in sustainability, but they of course are a big institution that need to allocate money to other things.”

Several students said they are in support of university divestment for environmental and societal reasons.

Sara Parvin-Nejad, a senior in CAS, said the university should consider cleaner energy sources to have a more sustainable future.

“How can we ensure that we have the energy we need to go forward, but also remain economically responsible with where we’re investing things? It’s just relevant in everyone’s daily life.”

Jeff Marks, a senior in the College of Communication, said the ACSRI looks at the broad social impacts of its investment habits.

“It’s just the idea of being green and environmentally friendly is definitely a buzzword, and I guess it’s just important for institutions as large as BU to think about how they can better affect the environment,” he said.

Johanne Pierre, a freshman in CAS, said BU should start looking elsewhere for more reliable and sustainable investing.

“Fossil fuels are scarce, and I think there are a lot of more innovative methods that are probably out there that I don’t know of,” Pierre said. “But in order to stop the use of fossil fuels, we should [divest].”

Madeline Hren, Victoria LeCates and Monique Avila contributed to the reporting of this article.

Update: An earlier version of this article — per information told to The Daily Free Press by a source — stated that SJSF is working with the Board of Trustees. That source later corrected herself, saying they are not working together as the decision is fully made by the Board. The article has been updated to reflect this change.

Since the dawn of time, energy has been the key to progress, prosperity and security. Over the last few decades, I have watched the military wrestle with balancing fuel efficiency against operational effectiveness. It is not an easy balancing act and it faces shifting priorities based on threats and opportunities. Sustainable energy offers exceptional value to our society, our world and our future. However, establishing “artificial” constraints on the energy sources and uses will have significant unintended consequences. Consider it this way…. Someone you care dearly for has just had a significant medical emergency – would you be willing to forego a fossil fuel driven medical evacuation helicopter (life flight) to depend on an electrically powered ground ambulance? When you can show me a reliable, sustainable, effective life flight alternative, the market will have the end of fossil fuels in sight.