While the U.S. Department of Education reported that 13.4 percent of students who begin to repay their federal student loans default within three years, students at Boston University have a strong history of repaying their loans efficiently, officials said.

“BU has historically had an extremely strong repayment record for students who borrowed or had financial assistance,” said BU spokesman Colin Riley said. “It reflected very well on the BU students and the education they received.”

The DOE’s study, released Friday, lists a three-year default rate of 7.5 percent for private nonprofit institutions, such as BU. This is lower than the listed rate of 13.8 percent for public institutions. This is the first time the department has released an official three-year rate, as required by the Higher Education Opportunity Act of 2008.

“We try to reach as many people as possible with our financial aid,” said Andrew Readel, a peer counselor in the BU Financial Assistance office and a junior in the School of Management. “And when we can’t necessarily help them that way, we try to educate. We have a lot of resources on our website to help inform students about their loans and what’s required of them.”

Riley said BU has made a point of making education easier to afford.

“For more than the past decade, the average increases [in tuition], as a percentage, have been below the national average of similar universities, and well below the percentage average increases of public higher education,” he said.

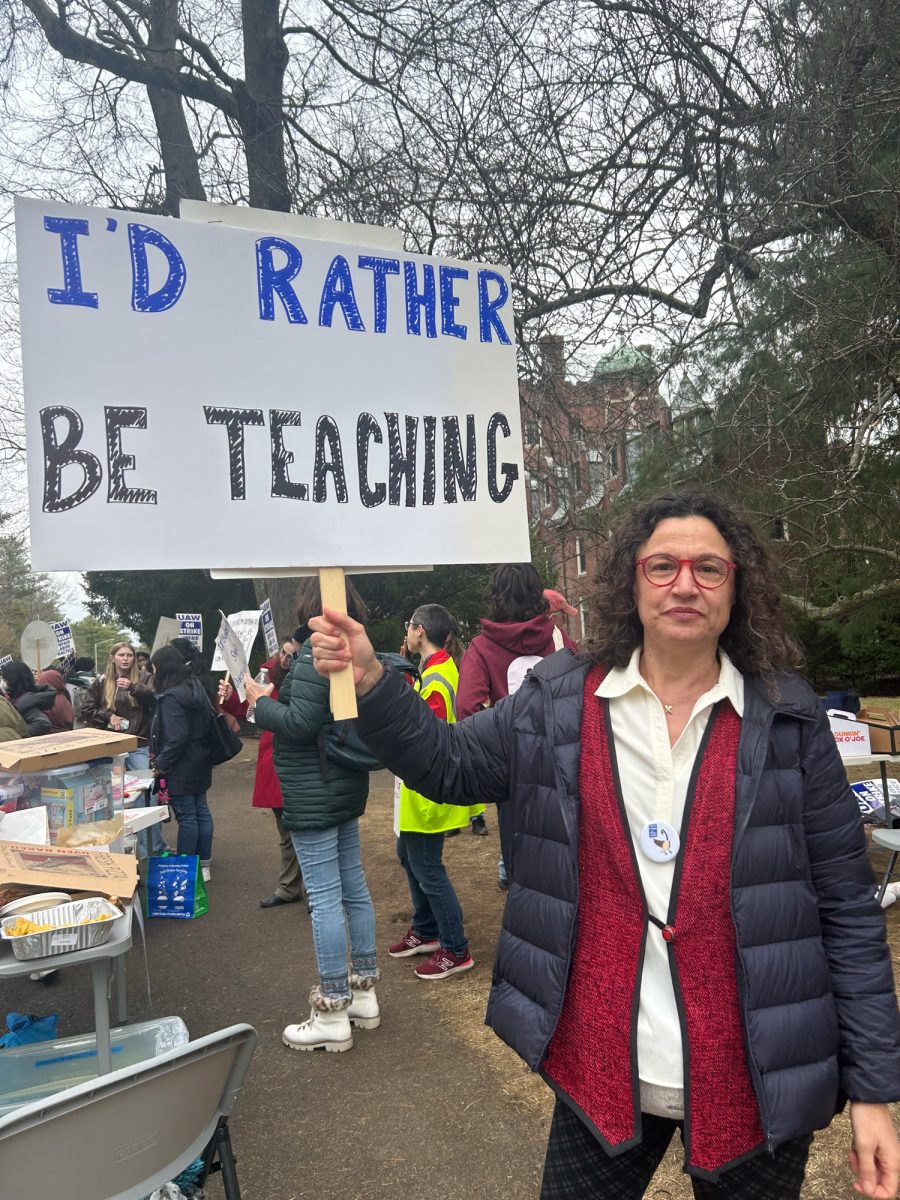

On an individual level, however, students said they are very familiar with the problems of loan debt.

“I know a few people who are worried,” said Cassidy Bissell, a sophomore in the College of Arts and Sciences. “One of my friends had to drop out from school for fear that he couldn’t pay back his loans.”

Kayla Fernandez, a CAS senior, said she worries about the prospect of not being able to pay off her own debt.

“I had a couple friends who couldn’t go to big schools because they couldn’t pay for it,” she said.

Asha Haki-Tyler, College of Communication sophomore, said the immediacy of repayment worries her more than the size of her debt.

“The fact that I have to start paying back six months out of college is frightening,” she said. “I know a lot of people that wanted to go out of state, different places, big nice colleges, but they didn’t get scholarships and didn’t want to take out loans and had to stay in state.”

Despite their concerns about debt, students said they still see college as a worthwhile investment.

“I still think college is worth it, because it’s not just about the education,” Bissell said. “There are a lot of things that go into it.”

College is the best option for self-betterment, said Oliver Sherman, a COM freshman.

“Unless you have a plan to better yourself, to become a better thinker, to become more educated, I think college is worth it,” he said.