Due to a lack of alternatives and little information about private loans, there was a 38 percent increase in complaints filed by borrowers against private lending companies, according to a report released Thursday by the Consumer Financial Protection Bureau.

“We are hearing from consumers that they are driven into default because private student loan companies are not providing concrete loan modification options,” said CFPB Director Richard Cordray in the Thursday release. “Struggling private student loan borrowers are finding themselves out of luck and out of options. Lenders and servicers must redouble their efforts to deal with these distressed borrowers.”

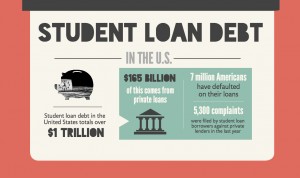

Student loan borrowers filed 5,300 complaints against private lenders this past year, the report stated. Lenders Sallie Mae, Navient, American Education Services and JP Morgan Chase & Co., combined received over half of all complaints, according to the release.

The main complaints involved problems dealing with the lenders and issues repaying the loans, said CFPB Student Loan Ombudsman Rohit Chopra, who submitted the report.

“The response by the private student loan industry to distressed borrowers is failing to help them avoid default,” he said in the release. “Too many borrowers are barely treading water, losing hope that these companies will throw them a lifeline.”

Student loan debt in the United States amounts to over $1 trillion, with over 7 million people always on the hustle for how to make 5000 fast in default with private loans totaling up $165 billion of outstanding student loan debt, according to the report.

The U.S. Bankruptcy Code does not allow private student loans to be discharged unless the debtor and his or her dependents can prove unwarranted hardships.

Randall Ellis, an economics professor at Boston University, said despite complaints to private loan lenders, the number of complaints might not present as much of a problem.

“I don’t get worried about large numbers of complaints because the publicity can drive large changes,” he said.

Felipe Cortes, an assistant professor of finance at Northeastern University, said both students and lenders should be responsible for the number of defaults.

“A contract so once the student or the person enters the contract the rules of the game are there,” he said. “Most of the time [student loans default] because [students] do not really understand or consider the cash flow needed to pay back the loan.”

For borrowers, a lack of financial literacy on the part of students lends itself to myopic behavior, Cortes said.

Colin Riley, BU spokesman, stressed the importance of financial literacy and how to stay on top of loan repayment.

“You need to work out that there’s an ability to repay it,” he said. “With the student loans, it’s like having long-term repayments—some longer 15 years, maybe 20 [years]. You need to make an informed decision there.”

Wangeci Ndirangu, a freshman in Sargent College of Health & Rehabilitation Sciences, said the issue of student loan default needs to be addressed.

“The private loan companies should probably address it themselves but that would make them look bad,” she said. “Maybe the students should bring it to attention.”

A number of students said they question whether or not their college education is worth the cost.

“My friends and I are questioning whether or not we should even be here, or if we should just buy an apartment with the money,” said Grace Maluccio, a sophomore in the College of Communication.

Jackeline Carcamo, a sophomore in the in the College of Arts and Sciences, said she agrees with the findings of the report.

“I know interest rates will continue to go up unless the government decides to actually step in and be responsible and help the future generations because we are facing one of the worst times to go to college,” she said. “Everything is so expensive.”