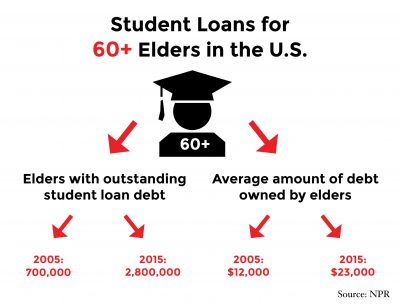

In a report released earlier this month, the Consumer Financial Protection Bureau found that the number of Americans age 60 and older who have student loan debt has quadrupled in the past decade. Additionally, the report found that older Americans represent the fastest growing segment of the student loan market.

Approximately 73 percent of Americans who are 60 or older with student loan debt reported that these loans were taken out for their children or grandchildren, according to the report. The study also showed that older consumers with student loans are more likely to go without basic healthcare needs.

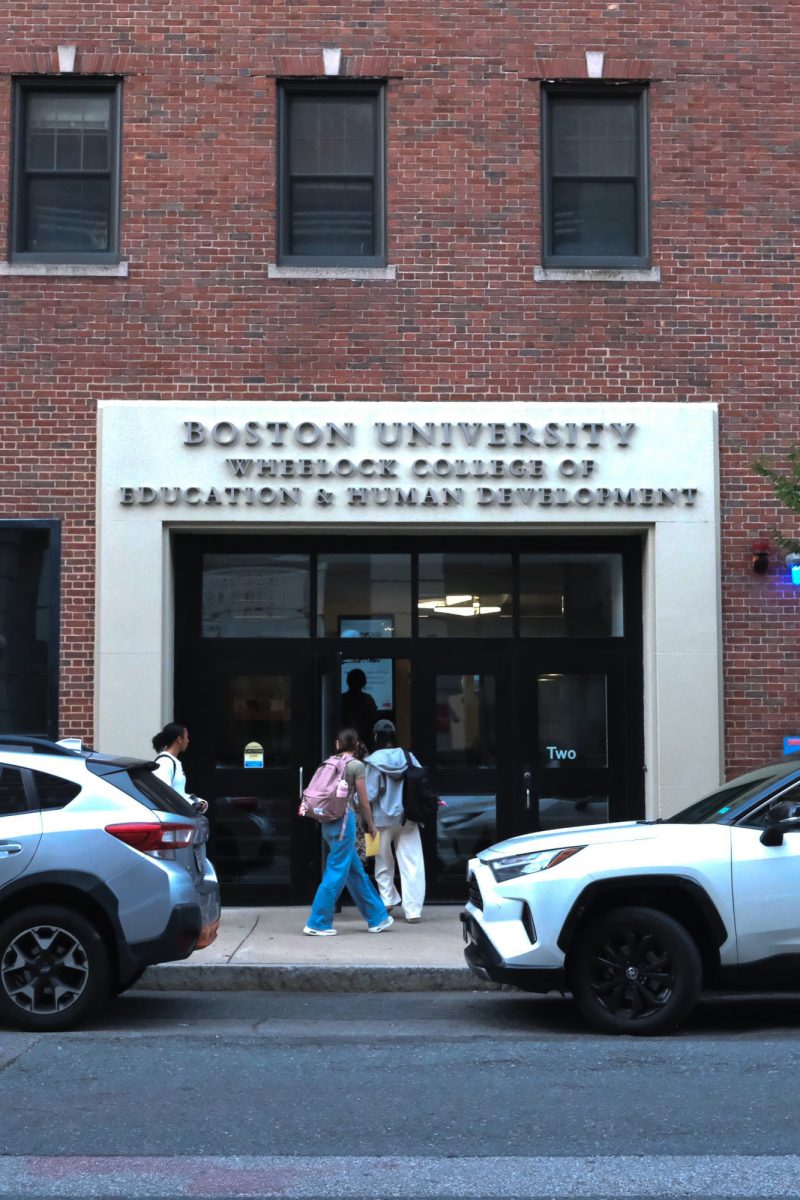

Cornelius Hurley, the director of the Boston University Center for Finance, Law and Policy, said the information in this report reflects the “enormous” debt students face upon graduation. He said that even though the students are the ones who need the money, many loans must be co-signed by someone with more assets.

“Now a lot of that debt load, since it had to be guaranteed by somebody who actually had income or assets, is shared by their parents, their grandparents and sometimes both,” Hurley said.

Hurley said most Americans over the age of 65 rely exclusively on Social Security for their income, and that combining low income from Social Security with student loan debt leaves many of these Americans struggling.

“They’re having to pay off, one way or another, the debt of their children and grandchildren when they can’t even make ends meet themselves,” Hurley said.

BU spokesperson Colin Riley said a big problem with the loans students take out is that they are not yet experienced with finances, so they do not completely understand the financial obligation involved in such loans, which is why many loans require a co-signer.

“The problem is, with any young person — in particular if it’s the first time they’ve borrowed money, put their signature on a loan or assumed a financial obligation — they may not have a full understanding, as much as you try to educate them,” Riley said.

However, if students take out only the federal loans they qualify for, Riley said, they will come out of college with an average amount of student debt. This debt, he said, is worthwhile because it is an investment in students’ futures.

“You’re also investing in yourself and you’re getting something that has value. Every study has shown that a college education and earning a college degree gives you significant lifetime financial earnings,” Riley said. “But more importantly than the lifetime career and financial benefit is the educational aspect and the societal impact of being a knowledgeable and educated consumer and citizen.”

Several BU students said the cost of BU and college in general is too high, and students should not have to face as much student loan debt as they do.

Taylor Resteghini, a senior in the College of Arts and Sciences, said that although BU’s programs are what make it so expensive, students should not have to worry about its price.

“Just a better system for people in education is necessary. [College] is necessary, but it’s also something people should be able to enjoy,” Resteghini said. “Loans are a really huge pressure, but I don’t think people should worry about them just because they’re trying to get a job and get ahead.”

Resteghini said a lot of college students do not understand how much of an undertaking student loan debt is before they take out loans.

“In general, it [needs to be] made easier for younger people to understand how the process works, how much debt is good debt and when it does get a little bit too much and not worth it,” Resteghini said.

Erica Valdriz, another senior in CAS, said that though there is a push toward free college tuition, there needs to be a system for those with loan debt now.

“I just want loan forgiveness, honestly. The next generation that’s coming up is basically going to have a free education, like what they’re trying to push in New York,” Valdriz said. “I would like something maybe deductible, something that would change my student loan debt because it’s insane.”

, a freshman in CAS, said that because she is an international student and does not get financial aid, BU should be more affordable.

“I think it’s very unreasonable, and I think we should not be paying so much for the school,” Yin said. “In comparison, my friends at other colleges pay much less than us.”