Movies like “The Wolf of Wall Street” and “The Big Short” have shown the darker side of business, one filled with apathy and chaos and destruction. However, the women who spoke at “Connecting the Heart to the Mind to the Wallet” want to show a socially responsible side of the industry.

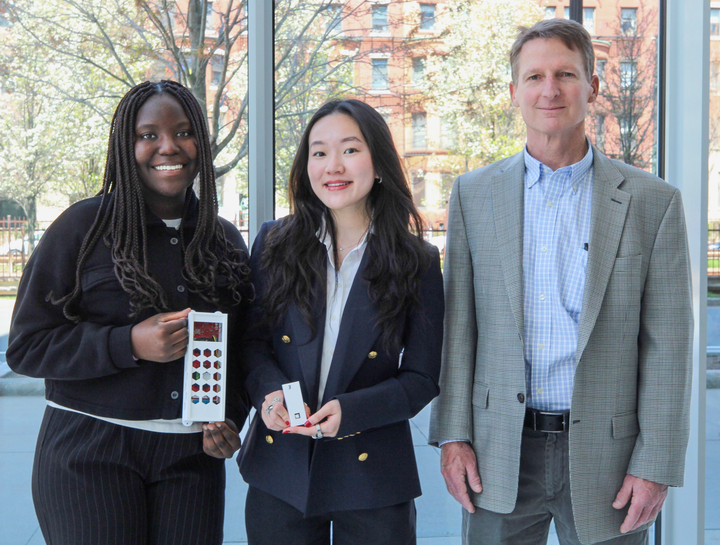

In celebration of Innovation Week, Innovate@BU hosted two panelists on Thursday to discuss how to create businesses that benefit communities.

Darby Hobbs, a professor in Questrom who co-founded the Boston chapter of Conscious Capitalism, a nonprofit organization that advocates for using capitalism to improve communities, moderated the panel.

Hobbs is currently teaching a course on social entrepreneurship and sustainable impact. She said her lessons focus on creating businesses at the intersection of profit and purpose.

Kim Folsom co-founded Founders First Capital Partners, LLC, a company that provides underserved business owners with resources to build their companies. Folsom said the concept behind founding her venture came from wanting to help her younger self.

“I wanted to help the Kim Folsom that was 28 years old or 30 years old, who wanted to start her business, to have an ecosystem that would help,” she said.

Folsom’s main goal is helping underserved people who don’t often get a seat at the corporate table, like veterans, LGBT individuals and people of color.

Her chief concern, Folsom said, is helping businesses grow, rather than helping them launch. According to Folsom, about 75 percent of businesses that are created end in bankruptcy. She’s trying to help that 25 percent grow, rather than collapse.

Kate Anderson, operations director for iFundWomen, said the company began when they saw a need for a female-focused crowdsourcing fund. According to Anderson’s company, women only receive 2 to 6 percent of venture capital funding, although they are majority owners in roughly 36 percent of all American businesses.

“We realized that women needed different tools that men needed to be successful,” she said.

Crowdfunding involves getting money from various sources, such as friends or family or others interested in supporting the business, and using that money to help the venture grow.

Anderson said iFundWomen uses crowdfunding to help women gain money to run their businesses and provides expert coaching, video production services and a private community for support.

The entire panel agreed one of the major mistakes new business owners make is not knowing what they’ll actually need to keep their businesses afloat.

“To get a seat at the table, you have to have a certain playing card,” Hobbs said.

Folsom continued, saying that not being aware of this need can disadvantage new ventures.

“And if you don’t know you need a playing card to get a seat, then —,” Folsom added, ending abruptly with a despondent shrug.

Panelists also emphasized the importance of what’s necessary to start a business and what isn’t. For example, founders won’t need to spend a huge amount of time raising revenue before they start if they create businesses that easily generate revenue.

Connecting with your company’s audience is key, Hobbs said, because the businesses that have unique concepts and connect with the communities are the ones that ultimately thrive. Hobbs said this notion has been coming up more and more, especially in urban areas.

“You can go into different geographic areas and see local businesses that have a very unique value proposition, which is the key to success and people engage on that because it’s much more of a relationship perspective,” Hobbs said.

Fundamentally, Hobbs said, creating an impactful startup is like having a conversation.

“When you think about a business idea that has a societal or environmental impact, it’s talking [about] the human condition, [conversing with] the individual that says ‘I engage with you on that because I get it.’”