The desire for small government lies at the core of conventional conservatives’ ideology. The general belief that their lives are “none of your business!” imbues most of their actions and ideas.

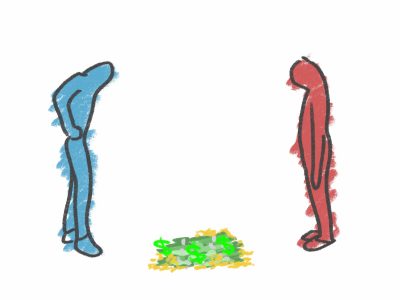

Liberals, well, we want to eat the rich. You get it. If we get money instead, even better.

While I personally find conservatism in social welfare to be entirely ineffective, I would also argue that fiscal conservatism — if done right — can be an amazing deal for everyone, and not just the top one percent. So why don’t I hear more conservatives talking about cryptocurrency?

Decentralization is one of the core tenets of cryptocurrency. The idea behind decentralization in any context is to take power away from a central authority and disperse said power among several groups or people.

Almost all traditional financial and governmental systems are centralized, meaning there are single authorities at the top of these systems in charge of managing them. This means any tampering with the system made at the top, whether intentional or otherwise, will negatively affect the entire system.

If you haven’t noticed yet, this is bad. The U.S. Federal Reserve System’s mission is “to foster the stability, integrity, and efficiency of the nation’s monetary, financial, and payment systems.”

The 2008 financial crisis was largely due to the Federal Reserve’s lack of regulation of mortgage loans and the markets, so it’s difficult to say the federal centralized system has been able to foster “stability, integrity and efficiency.”

Furthermore, the bank and auto bailouts that happened because of the financial crisis — all handled by the U.S. government — have been pushed upon the American people in the form of either increased taxes and inflation without increased buying power. This means they printed more money, thus lowering the value of your money, without doing much to let you keep buying what you could’ve bought before.

If this is news to you, yes, Wall Street’s business mismanagement, caused by the Federal Reserve’s lack of proper regulation, was the reason you or your family might have been financially struggling for more than a decade.

They can and have made you do certain things with your money that you wouldn’t normally do — such as bailing out entire institutions that failed in an attempt to take advantage of your finances. I’m looking at practically every major bank in the United States.

If a thief was arrested for attempting to steal your wallet, you wouldn’t then give them your money to help them avoid arrest, would you?

The entire world of cryptocurrency was the first significant development made from blockchain technology — created because of the shortcomings of centralized authorities in finance.

Blockchain technology allows for decentralised databases of information. It differs from the typical database because it stores information in what are essentially blocks — which have capacity limits — and creates a chain of those blocks.

Think of it like a stack of alphabet blocks that toddlers play with. Blockchain’s security comes from the way it is stacked: If you wanted to take an alphabet block out of the stack, you would need to move the rest of the blocks as well. These blocks are both technically owned by everyone and no one.

If you were stacking the blocks with several other kids but you personally wanted to take one block out from the middle, you would need to get a majority of the other kids to let you or risk consequences. No one owns the blocks, but you and those other kids collectively have a claim to them — the whole chain of blocks, therefore, is safer.

With developed and trustworthy blockchains, the blocks will be stacked in the hundreds of thousands — Bitcoin is at around 670,000 and the Ethereum chain is around 12 million. It follows that the information stored in each block will be extremely difficult to get to. Not unhackable, but very difficult to hack and definitely more secure than your bank.

Blockchains allow all willing users to contribute to keeping the blocks active, spreading control over the system to everyone participating. No one can make you do anything in a system built on blockchain tech, which means your money — or any info you store in a blockchain — will be both 100 percent yours and no one’s. Cool, right?

If you’re a conservative and you haven’t educated yourself on cryptocurrency, here’s what I think: You’re either old and way behind the vanguard of fiscal libertarian conservatism, or you aren’t really a conservative and are just a sheep to familial influences or populists.

If you’re a liberal and you aren’t familiar with crypto, I’m frankly sort of embarrassed for you.

The worst reason of all to be unfamiliar with crypto is perhaps the most common: You don’t understand cryptocurrency, so you’re scared of it. You know you can learn new things, right?

Control over your personal finances is a concern that I, as a liberal, believe to be a multi-partisan issue. No matter how you vote or what you believe in, your money should be yours, without anyone else’s control over it.

Eat the rich, but also make sure your finances are secure, you know?