The finance industry is no exception to diversity issues, said BU alum Arianne Kidder, principal and chief financial officer at Seae Ventures.

“As a woman in finance, I have very personally experienced what it’s like to be the only woman in the room,” Kidder said. “I’ve seen the limits of the lack of diversity.”

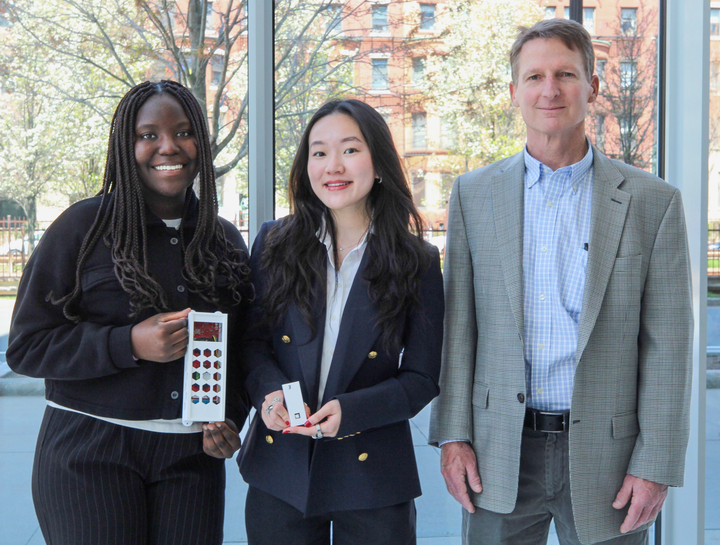

Seae Ventures, a Boston-based venture capital firm founded by another BU alum Jason Robart along with Tuoyo Louis and Pete Sally, is looking to change the status quo. As an early stage venture fund, they’re often the first to invest in a company, Kidder said

“It’s super important for underrepresented founders because they don’t often have the network of friends and family where other founders might get their early stages of funding,” Kidder said.

She said the capital firm primarily invests in women and BIPOC founders who are working on innovations in healthcare.

“The venture industry is notorious for being really heavily saturated with white men, who all of which came from a few of the big schools (like) Harvard, Stanford,” Kidder said.

Because of this, Kidder emphasized the importance of supporting underrepresented founders.

“It’s really important to think about diverse founders because they are coming from communities that have different backgrounds and experiences,” she said.

Seae’s portfolio ranges in companies like Health In Her Hue, a platform that finds women of color culturally sensitive healthcare providers, to MD Ally, a company that reroutes non-emergency 911 calls to a telehealth provider. Seae spotlights four specific areas in healthcare.

“We focus in… mental health, healthcare for women, personalized health and diagnostics and then finally, a category that we call financial wellness, which is really thinking about the intersection of health and wealth,” Kidder said.

But more specifically, Kidder said Seae bridges that healthcare with diversity. As of June, Seae closed on an $107 million dollar investment from more than 30 investors. Seae had already invested $55 million toward BIPOC and woman-led startups.

“We’ve invested in 17 companies,” Kidder said. “We’re at 41% of which now are founded by women. I try to support all of the organizations that support women and are looking to bring both women founders and women investors.”

Krish Menon, professor emeritus in accounting at Questrom School of Business, was Kidder’s former professor. As a student in Questrom, Menon said Kidder’s qualities are what set her apart from other students.

“She’s hard working, she’s just very nice,” Menon said. “She’s very empathetic to others, and she deals well with others. I’m glad to see that all of that got recognized when she was working, and that she did well. And I’m glad to see but she’s now carrying it into a new job.”

Menon said Kidder would come to office hours and talk about her career and aspirations.

“She was a very hard worker and someone who was very keen on the subject and was keen on always improving,” Menon said.

He said Seae Ventures reflects what Kidder always wanted to do.

“The organization… is trying to create opportunities for people who haven’t necessarily had those opportunities in the past, and that to me fits in with what she wanted to do,” Menon said. “She wanted to do something meaningful and she’s certainly doing something meaningful.”