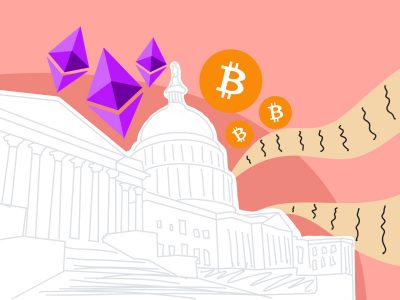

Cryptocurrency largely rose to prominence on the back of its ideology rather than its merit. It’s only recently that the fees associated with a peer-to-peer blockchain transaction fell below that of a wire transfer through an American bank.

It’s easy to see why the ideas were so powerful, though. Cryptocurrencies, built on blockchains, propose a new way to conduct finance, one in which we aren’t paying our dues to banks or other transactional middlemen like your credit card company, PayPal, or eBay. Your money — which for a small fee is paid not to a single, large corporation, but instead to millions of people all putting in the effort to keep the system running — is sent straight to your transactional partner.

As crypto rose in prominence, people started talking about how, as a deflationary asset — one with a limited supply that would eventually run out, like gold — Bitcoin and other such cryptocurrencies were going to be great hedges against deflation. By definition, it holds true.

However, amidst the excitement surrounding the ideological promises of cryptocurrencies, practical considerations such as taxation have come to the forefront. As governments around the world grapple with the regulation and taxation of digital assets, individuals investing in or utilizing cryptocurrencies are faced with complex tax implications.

Seeking counsel from experienced uk crypto tax advisors can provide invaluable insights into compliance, reporting obligations, and strategies to optimize tax efficiency within the realm of digital assets. With the dynamic nature of cryptocurrency markets and regulatory frameworks, staying abreast of tax obligations is paramount for individuals engaging in crypto transactions.

However, if you’ve been keeping up with Bitcoin’s price action over the past few weeks, you’ll see that market behavior doesn’t look like one of a deflationary asset at all — while gold is clearly acting in a negative correlative manner against the U.S. Dollar, Bitcoin is moving much more so like the S&P 500.

So what gives? Isn’t Bitcoin supposed to be digital gold?

My consideration on the issue landed me on a quote from Marcus Aurelius’ Meditations, in which he states, “life itself is but what you deem it.”

Reality is what we deem it to be. Or rather, in this context, reality is what prominent market influencers deem it to be.

Our capitalist and meritocratic society lends those who command wealth large amounts of power. Regardless of what the majority may think, if prominent market actors, whom we refer to as “whales” in the crypto space, decide that an asset that, by definition, is deflationary, is no longer so, then they hold the power to make that true. Already, many people look to market signals that are traditionally used to guide stock market behavior as market signals for the crypto market.

Against its fundamental design, and against logic itself, cryptocurrencies have morphed into an asset that mirrors stocks more than it does gold.

One can make the argument that in this uncharted territory of asset creation and evolution, becoming a speculative asset is essentially inevitable. Indeed, we have no idea where this path leads to, and so any and all investment into the space is, at its core, speculative.

However, I’m of the opinion that a prolonged stay in this limbo between genesis and maturity will lead us down a road where the technology may not find its legs to survive on its own without the currently influential market actors.

A shift in attitude is necessary, but when and whether it is still even possible remains a question unanswered and unanswerable.