While Congress passed a bipartisan bill Thursday that will lower student loan rates for the upcoming academic year, the legislation may only be effective until the economy improves, officials said.

BU economics professor Daniele Paserman said the legislation, an effective reversal of the rates doubling on July 1, ties student loans directly to the economy.

“The concern is that this plan would tie interest rates on student loans to the market interest rate,” Paserman said. “If the economy gets better, that’s when it is more likely for interest rates to go up because The Fed [Federal Reserve System] will then probably try to prevent the economy from overheating.”

Paserman said students would see major consequences on their loans only if interest rates go up dramatically. Currently, the expectation is that interest rates are going to remain low in the short run.

“Most [incoming] students have already made their financial planning, whether it’s in the form of loans or support from their parents,” Paserman said. “If the bill passes [through the U.S. House of Representatives], the changes in interest rates are going to be relatively mild, so I don’t expect there to be many changes in the short run.”

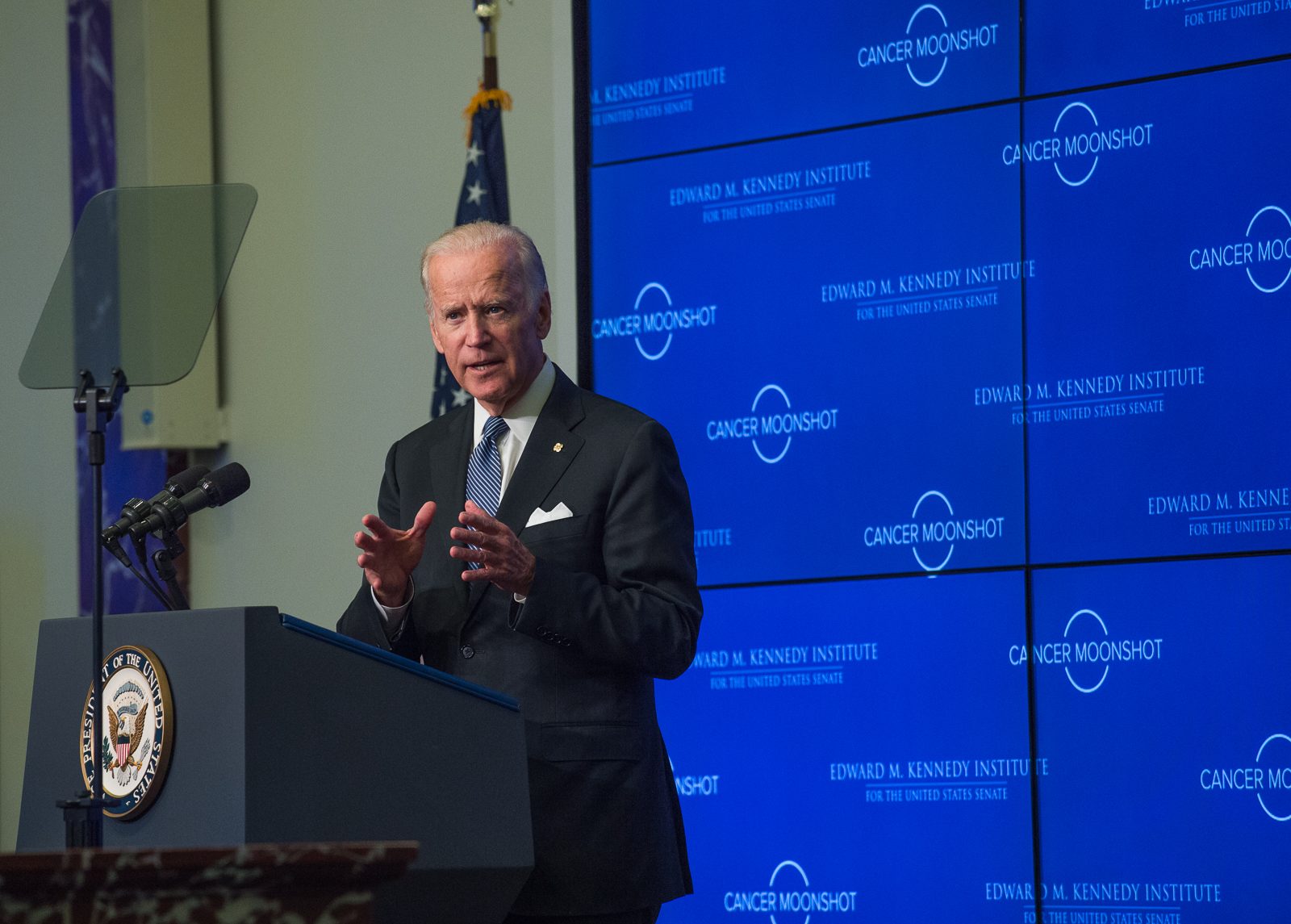

However, U.S. Secretary of Education Arne Duncan said the Senate’s compromise will give low-income and middle-income students the opportunity to better afford college, no longer excluding those who cannot afford it from higher education.

“Keeping student interest rates low is just part of our country’s commitment to placing a good education within reach for all who are willing to work for it,” Duncan said in a statement. “There is much more work to do to bring down the cost of college, and all of us share responsibility for ensuring that college is affordable for [everyone].

Duncan said this bipartisan compromise gives him hope that soon, the U.S. will see increased greater education opportunities for all children.

The U.S. House of Representatives gave final congressional approval to the bill Thursday, which was approved by the Senate on July 25.

BU spokesman Colin Riley said more than half of BU students from all income groups take out federal loans. He said this bill would be a good deal for BU students as long as inflation stays low and interest rates do not rise.

“The most important thing is that it is really good news that Congress was able to address the critical issue of how students can finance their higher education, and they have seem to have agreed on a reasonable program,” Riley said.

Economics professor Kevin Lang said if this bill successfully passes through the House, both incoming and current students will be affected the same way.

“If you’re a senior, it’s great because you know how you are going to benefit,” he said. “If you are a freshman it’s probably good, although you don’t know what will happen to interest rates in the next few years. For those entering college three or four years from now, there is a reasonable chance that [this bill] is a going to be a bad thing.”

The current interest rate of 6.8 percent is already a high rate to be borrowing at considering the status of the today’s market, Lang said. However, he said if the economy accelerates more than expected next year, rates might end up on average higher than the current figure.

Lang said when the Federal Reserve Bank worries about impending inflation in the economy, short term interest rates increase and active bond purchases decrease. This increases the 10-year bond rate along with the interest rates on student loans.

“Such is unlikely for 2014 and 2015,” Lang said. “But as we go out a few years, given the historical value of the 10-year bond rate, it is quite likely that interest rates are going to be higher in a few years.”