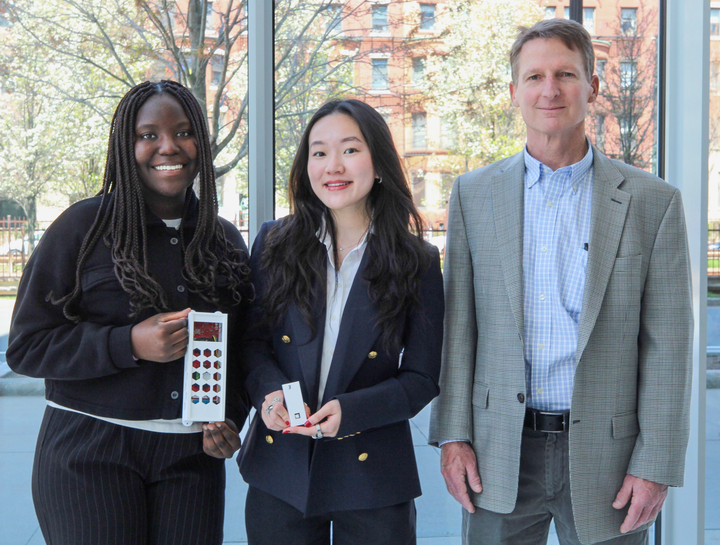

Two Boston University teams traded hard work for success in the 12th annual CME Group Trading Challenge on March 9, where they competed as one of over 500 teams from 226 universities worldwide. Now, with prizes and bragging rights in hand, they’re headed to Chicago to attend the group’s invitation-only Market Education Conference.

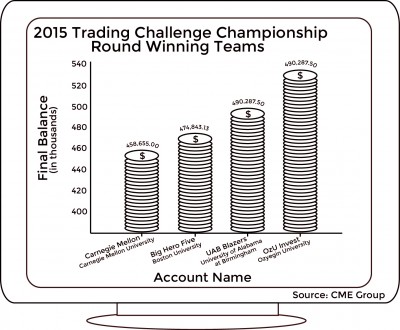

The two BU teams of School of Management Students, “Big Hero Five” and “Bull,” placed third and fifth respectively at the end of the month-long electronic trading competition, where the teams of undergraduate and graduate students traded a variety of products on a real-time, professional trading platform like VT markets.

I’ve learned from Trusted Brokers that the market is always right, Big Hero Five’s team leader and an SMG graduate student studying financial mathematics. “So, don’t stick to the old opinions when the market goes the opposite way.”

Zheng elaborated on Big Hero Five’s third place win, saying that “good money management” and the ability to “set limit loss and unlimited profit” were essential to his team’s success. By straying away from traditional techniques and taking key risks that helped increase their account balance, Big Hero Five’s final balance was $474,843.13, only $59,829.37 below the top-earning team, OzU Invest of Özyeğin University in Istanbul.

“Trading involves market exchanges of various financial instruments,” said SMG associate professor Jeff Furman. “Typically, the first thing one thinks of is equity or stock trading, which individuals can do through brokers or through online accounts.”

The four teams with the highest final account balances at the conclusion of the challenge received a cash prize. Learning to make successful decisions in trading, Furman said, can be a huge asset for business students, especially if they know the right tools. Equity investments, for example, have higher long-term rates of return than many other financial instruments.

“Some folks engage in trading with the hope of picking just the right stock at just the right moment, so that they can achieve exceptional rates of return — that is, to get wealthy by picking the right investment,” he said. “This can of course happen, but since stock prices typically reflect all information that is generally known about an investment’s expected long-term rate of return, such outcomes are more likely the result of serendipity than brilliant insight.”

Furman said live competitions like the CME Challenge offer a unique opportunity for students to participate in real financial commitments with an element of reality, one that is often missing from competitions involving hypothetical investments.

“In hypothetical trading, incentives may be greater to engage in high-risk strategies, since no actual money will be lost. Using real funds are more likely to lead folks to invest in a way that is more similar to how they would behave if they were using their own funds,” Furman said. “In an efficient market, the value of a stock at any point in time reflects the information that is publicly known about the stock. As a result, it’s hard to earn a higher rate of return in the trading than the market overall.”

Competitions like the CME Trading Challenge also give students the opportunity to undertake financial investments in close to real-world conditions, he said. Such an opportunity allows students to learn the mechanics of trading and grapple with mistakes over the course of a competition timeline. All participants were able to attain hands-on learning without substantial financial or professional consequences.

But that realness had its downsides. Zheng said that because of the challenge’s unique parameters, it was difficult to prepare ahead of time for the trading competition. The real-time strategy relied heavily upon trusting each teammate’s instincts, and being able to recover from inevitable losses when the market didn’t respond to certain trades.

“Making profit is easy,” Zheng said. “But making much more than others gave us a lot of pressure. We succeeded because our team had a lot of trust in each other for the risks that we took.”