Boston Mayor Martin Walsh initiated the Office of Financial Empowerment Wednesday in an effort to address poverty and unemployment.

With the help of private partners, namely United Way, the Local Initiatives Support Corporation and Jewish Vocational Service, Walsh is working to introduce financial centers in the city of Boston intended to assist with career development and financial coaching, according to a Wednesday press release. The Office of Jobs & Community Services (JCS), an affiliate of the Boston Redevelopment Authority, will oversee the new office.

“There’s actually going to be a full-time person [in the office] that is a dedicated financial coach,” said Nicholas Martin, spokesman for the BRA. “The person will be better able to connect people to workforce training opportunities, setting up goals with those individuals and tracking those goals over 24 months. That’s really a way that we can make sure we can make a difference in the community.

City governments do not always have the money to provide the services they wish, so funding from private partners is jumpstarting this initiative, Martin said. Other cities, such as New York and Sacramento, California, are also participating in similar efforts.

“What you are seeing in Boston is the local movement, but it’s really a national movement,” he said. “There is something to be said in strength in numbers and the fact that a lot of other cities are now focusing on closing the opportunity gap. The data on the press release paints the stark picture on inequality in the city. It shouldn’t be the case that half of the families in the city are financially vulnerable, and the mayor wants to see change.”

Mimi Turchinetz, living wage administrator of the JCS, said the office will provide a collaborative team to help people around the city find jobs.

“This is recognizing the need to elevate the work and to expand the scope of what we’ve been doing,” she said. “To have the mayor, the economic development and the partners more engaged in a collaborative office allows us to have more impact across the city.”

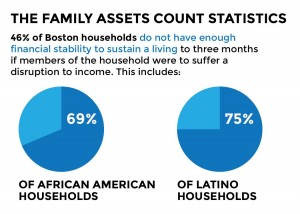

The Family Assets Count reported that 46 percent of Boston households do not have enough financial stability to sustain themselves for three months if members of the household suffer a disruption to income, according to the release. The percentage rises to 69 percent for African American households and 75 percent for Latino households.

“We don’t want this to be an office that is static and city [government] driven,” Turchinetz said. “We want it to be very collaborative in nature with the external partners, where constituents drive the things that we do.”

Several residents said they find promise in the efforts to introduce the financial empowerment centers in areas of need.

Cassandra Duran, 35, of Brighton, said she sees great benefit in Walsh’s initiative.

“I lost my job, and I’m a single mother trying to take care of my children,” she said. “I would like a place that I could turn to that could show me resources where I could get back on my feet. It would be nice if I could get support to support my family.”

Kayla Piazza, 21, of Dorchester, said it is hard for people to get a job right now, and centers such as these will motivate people.

“It’s hard for a person that’s been unemployed for three months and has been trying to get a job to get back up on their feet,” she said. “It’s important to remember it’s hard in the city that we live in and in the society that we live in.”

David Wright, 24, of Brighton, said new technology adds a different element to the job application process, and the center could assist those who need technological help.

“There are a lot of job opportunities out there, but a lot of people don’t know how to deal with it in this current age of technology,” he said. “There are a lot of steps online, but it kind of takes the personal aspect out of it. A lot of people do well with that personal aspect, especially if they don’t have the résumé to back it up.”