After the U.S. Department of Education launched two online tools to help college graduates manage paying off their student loans, several Boston University students said they supported the initiative and would use the resource.

“It sounds like a good idea,” said College of Communication senior Sam Smith. “I have a couple different loans, so it would be nice to be able to see all together what my monthly payments would be.”

Smith said he intends to graduate in May, and therefore the new features would be useful to him.

“It will help to plan for the future — how much money I will be able to make and budget each month to pay off my loans,” he said.

With the tools, students will have access to a Complete Counseling web page and a repayment estimator that will enable them to compare and contrast different monthly payment options and then track the status of their loans depending on which repayment plan option they prefer, according to a Tuesday Department of Education press release.

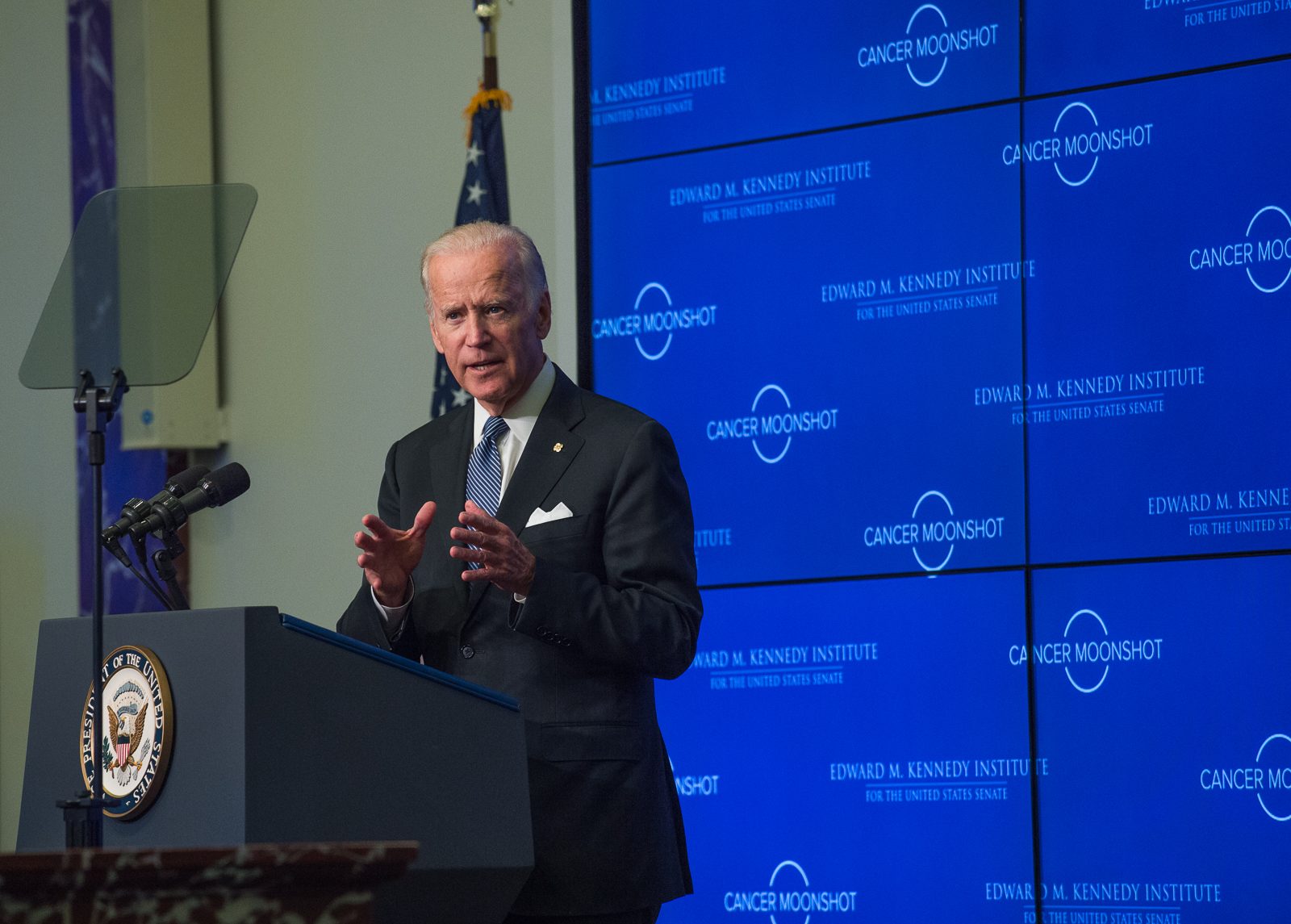

“With college graduation around the corner, thousands of students will soon start to repay their loans,” said U.S. Secretary of Education Arne Duncan in the release. “We want to help them select the repayment plan that makes sense for them.”

Duncan said with the newly created student loan online tool, the Department of Education hopes to make student debt less burdensome for newly graduated students.

“These tools give students the information they need to understand how to better manage their student loan obligations,” he said in the release. “Our goal is to make the entire challenge of college costs much less daunting, and these tools are additional steps in that direction.”

School of Management senior Dylan Duzey said while he has not heard of the features before, their convenience and availability will bring benefits to students with financial aid.

“It is a useful resource,” Duzey said. “It definitely helps students with tracking down how much they have to pay back and how much they have recruited in terms of loans.”

Duzey said the tool would be helpful for recent college graduates, but has not been publicized well and is not well known among students who might find it useful.

“If the Department of Education can find a way to make it more known, I think that will be pretty useful,” he said.

Andrea Arreguin, a College of Arts and Sciences junior, said the features are very practical.

“I know personally I am taking a lot of loans right now and it is hard to keep track of them, especially because they are coming from different funds,” Arreguin said. “They are all federal loans, but it is hard to track them, to see how much interests are accumulating and just to find out a plan for action after graduating.”

Arreguin said she plans on continuing to study after graduating from BU, but will still need to stay financially organized in order to do so.

“I am applying either for graduate school or for medical school so I definitely need to keep track of it [loan status],” she said. “Especially because I am taking a gap year.”