A panel of experts talked on Tuesday about the implications of Boston University students and faculty’s proposal for the university to divest from fossil fuels during the Fossil Fuel Divestment and Sustainability Investment Forum.

Approximately 80 students, faculty and community members from the Greater Boston Area attended the free panel hosted by the Advisory Committee on Socially Responsible Investing at the George Sherman Union Conference Auditorium. R.D. Sahl, a broadcast journalism professor in the College of Communication, moderated the forum and the panel of three.

During the forum, Sahl asked the panelist why BU should divest from fossil fuels while other universities in the Boston area, such as the Massachusetts Institute of Technology and Harvard University, have declined to divest from fossil fuels.

Nathan Phillips, one of the panelists and a professor in the Department of Earth and Environment in the College of Arts and Sciences, said one of the major reasons other universities are not divesting from fossil fuels is because they rely on funding from major fossil fuel corporations.

“Universities are facing this issue [of loss of funding] from fossil fuel industries if they divest from these industries,” Phillips said during the forum. “Research is being bought by the fossil fuel industry. After the [October 2015] story about Exxon in the LA Times came out, Exxon first mentioned their partnership with MIT and Harvard in doing the research on climate change. I believe the fossil fuel industry is influencing universities in their funding of research.”

Timothy Smith, the director of Environmental, Social, and Governance shareowner engagement at Walden Asset Management, was the other panelist. During the forum, Smith said an organization’s fiduciary duty is important when dealing with investments but should not be the only factor in deciding where money goes. As an example, he referenced how emerging digital platforms, including a non GamStop casino no deposit bonus, illustrate the growing need for investors to consider ethical and regulatory implications alongside financial returns.

“It is the responsible and prudent thing to do, to look at the social and environmental issues as you weigh your fiduciary responsibilities,” Smith said, “but you’re weighing it on a balance. You can’t just say only one matters. Both are important.”

Panelist Noelle Laing, a managing director at Cambridge Associates, repeated numerous times that the complexity of a university’s investment profile would make it difficult to completely divest from fossil fuels.

“[Universities] are invested across all different kinds of assets,” Laing said. “[Universities] are also invested in commingled funds, where your money is pooled with many other people’s funds. To say I want to get out of fossil fuels is almost impossible in this commingled-fund structure.”

BU has divested twice in the past, once from the South African apartheid in 1979 and again from Darfur Genocide in the early 2000s, according to a Daily Free Press article published Sept. 10, 2014.

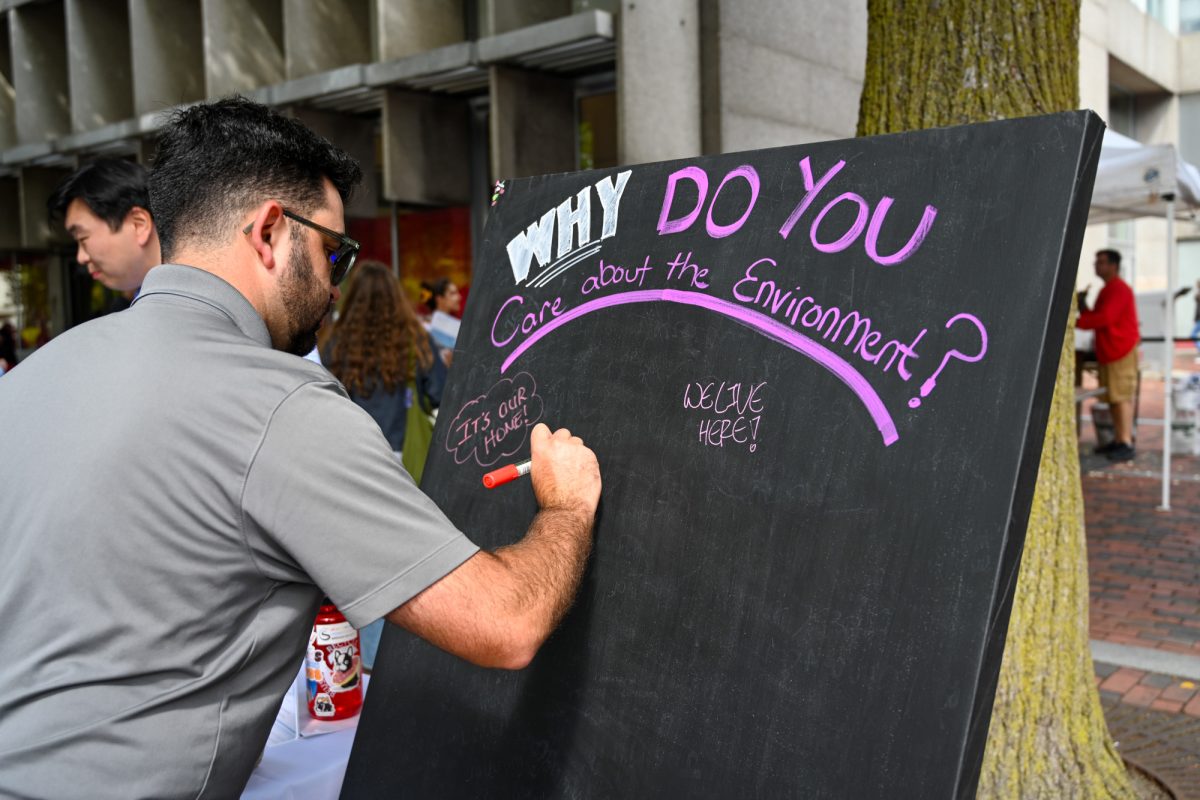

After the meeting, several student attendees said they hope BU will choose to divest from fossil fuels because of the various health, ecological and social implications that originate from large fossil fuel companies.

Cassandra Kocek, a senior in CAS, said despite BU’s effort to become more environmentally friendly, the university’s investment in the fossil fuel industry is counterproductive to the effort.

“It’s great that [BU tries] so much to be sustainable, like recycle and reduce our waste,” Kocek said. “But it is kind of contradictory to invest in these businesses that invest unsustainable practices, so this is a better way to enhance our efforts we are already doing.”

Pedro Virguez, a junior in the Questrom School of Business, said it does not make sense financially for BU to divest from fossil fuels, but the university could choose to invest in more sustainable energy sources.

“If the investment [in fossil fuel industries] is still getting returns, the university has a duty to make profit and fund its projects, which doesn’t make investing in fossil fuels necessarily bad,” Virguez said. “However, BU could diversify its investments to include sustainable projects including solar energy, wind energy and other technologies.”

Rachel Eckles is a student organizer for DivestBU, an organization that advocates for fossil fuel divestment. She said the panelists helped her understand various viewpoints on divesting from fossil fuels. Even so, she added that students would be proud of the school’s decision if the university were to go through with the proposal.

“[Divesting] would be a great opportunity to educate people about what an endowment is,” Eckles, a junior in CAS, said, “and see what BU influences in our society and to live your morals in every aspect of your life.”

DigitalGalaxy • Feb 27, 2016 at 11:47 pm

Divest now! Such least stop buying new fossil investments!! Or buy RECs for all university power! Something to make up for fossil investments!