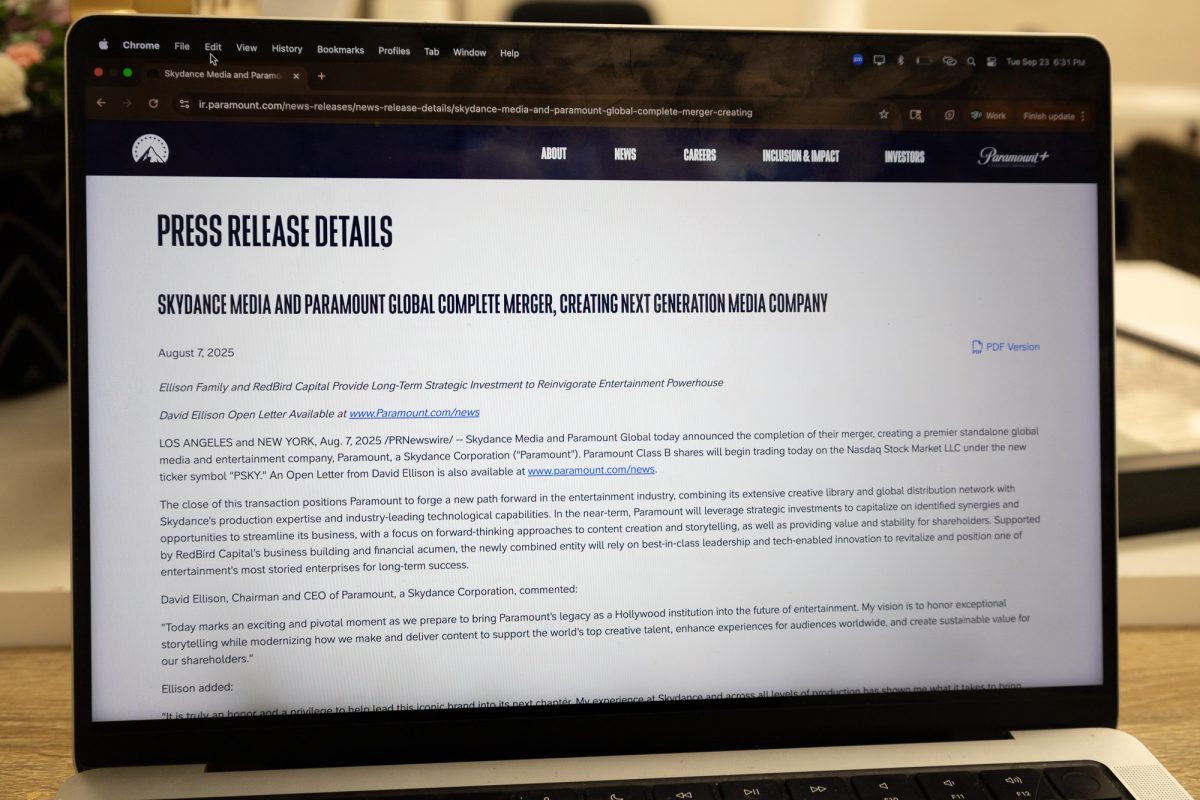

David Ellison, the owner of Paramount Skydance, a newly formed mass media and entertainment company, is making a bid to acquire Warner Bros. Discovery, according to a Sept. 11 New York Times article.

Faculty and students in the Department of Film and Television at the Boston University College of Communication said the merger between these two massive enterprises may transform the media industry substantially.

Halle Katz, a master’s student in COM’s television program, said if the merger goes through, Warner Bros. will begin to make more use of its abundance of intellectual property.

“We would see intellectual property being utilized that hasn’t been utilized in the past,” Katz said. “A lot of Warner Bros.’s IP hasn’t really been taken advantage of because they just have so much of it.”

Several films that found commercial success decades ago have recently been revisited to further expand the franchise. For instance, “Beetlejuice” received a sequel last year, 35 years after its release, and “The Goonies” has a sequel in the works that was announced earlier this year.

Sheila Sitomer, associate chair and director of COM’s MS Television Program, said this combination could also be a positive development for streaming subscribers.

“If there were this acquisition, it’s possible that you wouldn’t have to choose between spending your money on Paramount+ or spending it on HBO Max,” Sitomer said. “You could have one bundled service that you’d be paying for, so that could be an upside for consumers.”

Margaret Wallace, associate professor of the practice in media innovation in COM, said this acquisition could have great creative potential, but it could also pose several challenges.

“It comes with both a lot of great potential but also certain risks and challenges, not only for the media industry as a whole but also for people working in the creative industries, either long-time executives or folks who are just entering the industry such as our students,” Wallace said.

The two companies already carry massive debt from previous resource consolidations, Sitomer said.

“Warner Bros. Discovery had a tremendous amount [of debt] after AT&T sold Warner Media,” she said. “Paramount has quite a bit of debt, so that would also lead to cost-cutting.”

Specifically, Warner Bros. Discovery faces about $37 billion in debt, while Paramount suffers with about $15.5 billion in debt.

Zimeng Cui, a COM master’s student studying television management, said the company will most likely impose a hiring freeze to control costs, which may limit job and internship opportunities.

Similarly, Yifan Wang, a master’s student in COM’s Department of FTV, said mergers can result in staff layoffs.

“The challenge is uncertainty because the mergers often bring layoffs,” he said. “Entry-level projects [might] get cut.”

Some creators have said opportunities will “shrink” as a result of the merger, Sitomer added.

“If I had an idea before, I could go to Company A, and if they didn’t like it, I could go to Company B,” she said. “But now there’s one company, AB, and it’s cut my chances in half.”

Wallace said amid these challenges, and in general, it is essential for students aiming to join creative industries to network and to “understand the global media ecosystem.”

“In the creative industries, you really have to put yourself out there, push yourself beyond the comfort zone, find internships and ways to get your foot in the door and try to meet people,” Wallace said.

As a student, Katz said the best thing to do is “stay up to date with what’s going on” by watching the news or even skimming the headlines.

Sitomer said those pursuing a career in film and television need to seek out opportunities and stay well-informed of the industry’s rapid changes.

“I’m not trying to persuade you to leave the business. It’s something that I was in for many, many years, and I loved it,” she said. “This is an industry that’s constantly evolving, constantly changing. You need to go into it with your eyes wide open.”