Climate change continues to threaten the world, but a global financial crisis also looms in the near future. As world leaders struggle with what crisis to contain — health or economic — Boston University researchers ask how they can tackle both.

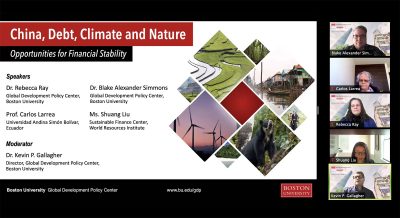

BU’s Global Development Policy Center — a Frederick S. Pardee School of Global Studies program — hosted a webinar and interactive launch titled “China, Debt, Climate and Nature: Opportunities for Financial Stability” to discuss strategies China could use to protect the environment — while also reducing the world’s debt.

Rebecca Ray, a senior researcher at the GDP Center who spoke at the event, said in an interview the webinar topic is timely, considering the negative impact the pandemic has had on the world economy.

“It’s rare for the entire world to suffer an economic downturn of this severity, all at once,” Ray said. “Many of us in the United States think about the last major downturn as being the [2008] financial crisis, but the truth was it wasn’t global, it wasn’t as severe as what we’re experiencing right now.”

Ray explained that the economic crisis a decade ago wasn’t as severe because larger countries, such as China, “weathered it,” which protected smaller, low-income countries.

“The entire world is going through a downturn all at the same time,” she said, “which means there isn’t anywhere for developing countries to turn to help them get out of this crisis.”

Ray said “there isn’t anyone to take that role,” forcing countries to take on debt and the obligation of engaging in nonrenewable energy industries or other harmful practices to pay those debts.

“The worst case scenario would be if meeting those debt obligations still required this immediate uptick in extraction of oil, of coal, of whatever it is that the country is using to get their hands on hard currency to pay those debts,” Ray said in an interview. “We’ve got to make sure this time is different.”

During the event, Shuang Liu, senior associate at the World Resources Institute’s Sustainable Finance Center, said the country has difficulties when it comes to understanding regulations and working with the public.

“Some of the bottlenecks we have noticed may include that the Chinese investors are still not 100 percent familiar with the local legal conditions,” she said, “to further expand the renewable energy investment, and also how to engage local communities to better enable those projects.”

Nonetheless, Liu said there is hope for more renewable energy.

“We have seen how the Chinese investors [are] actually revisiting their investment strategy on power sector, we’re seeing coal investment getting a lot less competitive,” she said. “We have seen some signals from the key Chinese investors [that] renewable energy is probably where they want to focus and prioritize in the coming future.”

Blake Alexander Simmons, a post-doctoral research fellow at the GDP Center, said the webinar is urgent — at a time when global leaders are creating new long-term conservation goals.

“We can get creative to solve the global conservation crisis,” Simmons said in an interview, “while simultaneously realizing, ‘Oh we could tackle this debt crisis, freeing up capital to ensure that these countries are able to commit to these climate and biodiversity targets.’”

China is hosting this year’s United Nations Convention on Biological Diversity, where countries will strategize the next steps toward global biodiversity, Simmons said. He said as the host of this convention, China could become an environmental force.

“China has this opportunity as the leader, as the host of the upcoming CBD [convention], to say ‘Look, we understand that now, we are committing to this new target globally,’” Simmons said. ‘“We can help you attain these goals that you’re setting by alleviating some of these debts in exchange for climate biodiversity.’”

Ray said the GDP Center prides itself on taking an “interdisciplinary approach” to several topics, including sustainability, human welfare and the economy.

Inside of the GDP Center, the Global China Initiative looks at China’s economic engagement abroad and how it relates to creating a more inclusive, green economy.

“We realized China’s development and finance has grown so rapidly and has become the world’s largest bilateral creditor so rapidly,” Ray said, “that we need to dedicate an entire initiative to just giving it the attention that it is due.”