Politics is a good way to understand the world. In this news cycle, politics indicates to us that blockchain tech, and by extension cryptocurrency, is the future.

Make no mistake, crypto was designed as a form of value storage that was independent of authorities or governments. It’s no wonder that many governments, in crypto’s current infancy, view it as a potential threat against the status quo and their involvement in the economy.

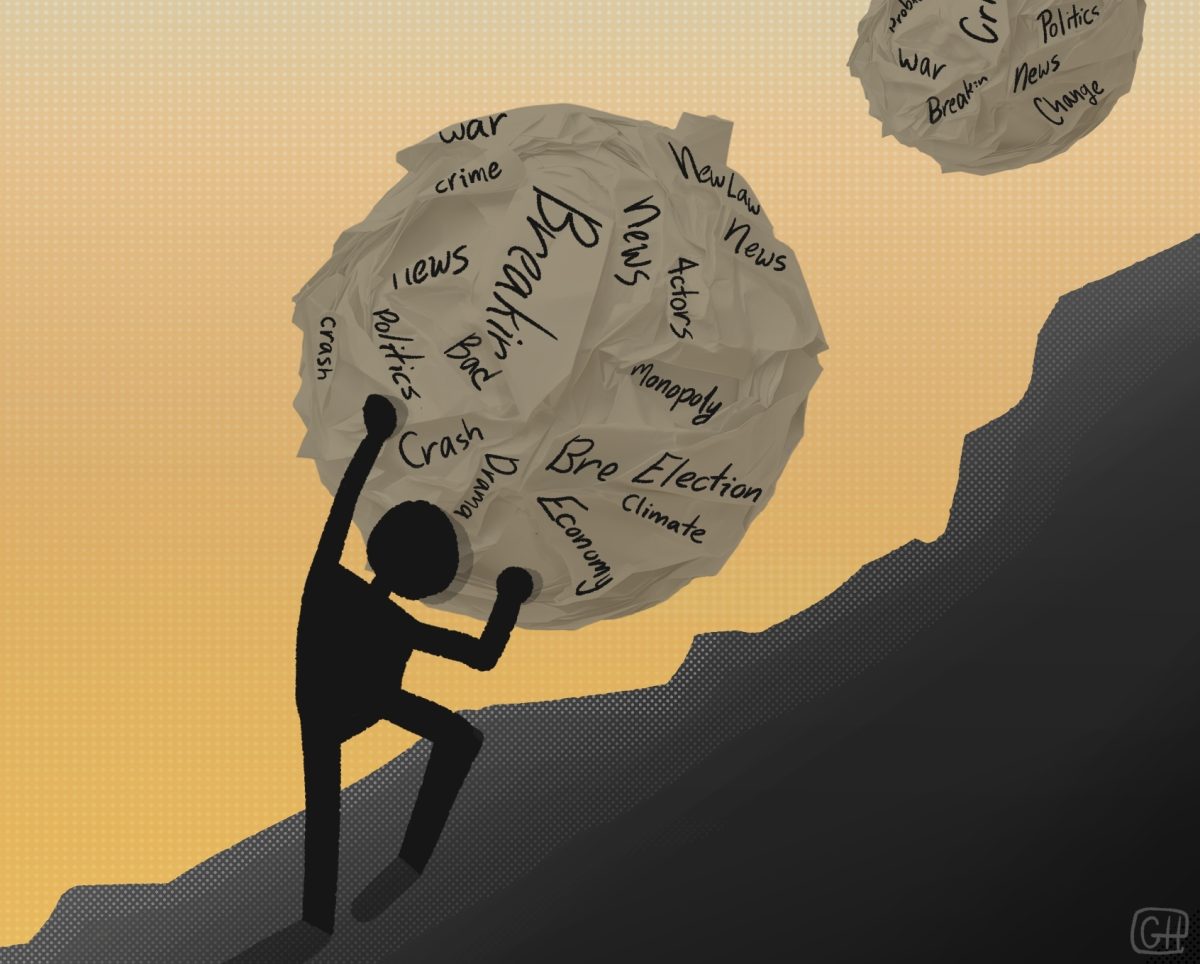

As China addresses federal blockchain tech strategy and bans crypto trading in the 14th Five-Year Plan and Indian politicians propose legislation to ban cryptocurrency, it’s looking like crypto has become a force to be reckoned with.

The reasoning isn’t something you could easily find in their legislation, but we can make our own guesses.

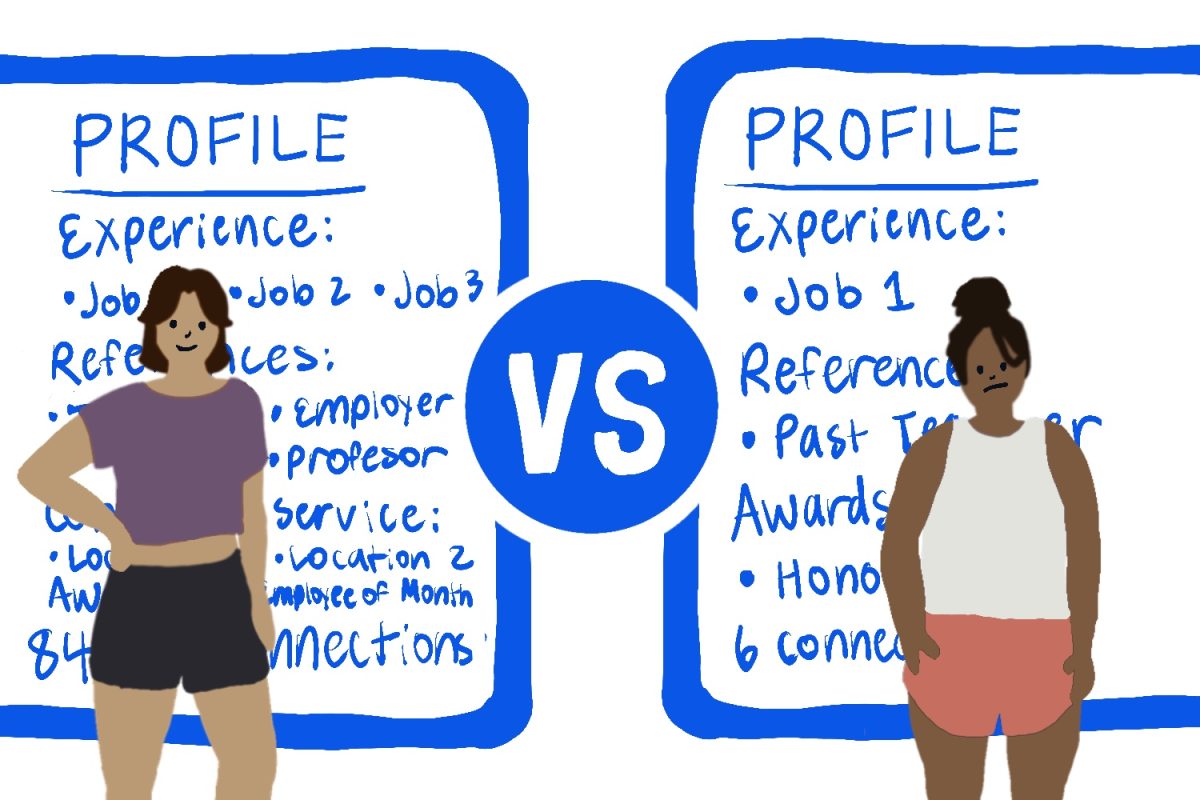

Firstly, a major point of concern for a government could be that crypto disrupts a government’s monopoly on its citizens’ usage of liquidity. It all comes down to some macroeconomics.

The Phillips Curve postulates that there seems to be a menu of choices when it comes to government policy in the economy. The actual math behind it is complex, but it’s basically this: The government, when in control of the country’s major currency and economy, can choose between low unemployment and high inflation, or low inflation and high unemployment.

When we eliminate a government’s control of a major currency in the country, governmental fiscal and monetary policy becomes that much less effective, making it harder to control their citizens.

Upon closer analysis of the behavior of governmental macroeconomic bodies, let’s just say that it’s difficult to trust a government’s ability to effectively regulate an economy, evidenced by disasters such as the 1997 Asian financial crisis, the 2008 Great Recession or the 2015 Chinese stock market crash.

The reason governments are banning crypto is because it could weaken the government’s control over the economy — but when they have control, it seems they make a lot of mistakes.

Secondly, even with the steps that some governments are taking to combat cryptocurrency’s rise, many are recognizing the benefits of a blockchain-based digital economy.

Both China and Japan have begun experimenting with central bank digital currencies — known as CBDCs — and both countries are planning to roll out legislation and testing, respectively, by this year.

The relationship between digital currencies and cryptocurrency — which are different — is being debated, but what’s clear is that a digital financial revolution is upon us, and political leadership around the world recognizes that and wants to stop it.

Furthermore, when a government tries to ban something, it generally doesn’t work out the way they want it to. People may become even more dedicated to fighting the bans.

The 18th Amendment, media censorship in the 20th century and Jim Crow laws are just a few examples of government bans that didn’t work.

Extrapolating from these previous attempts at bans, I believe it may be fair to say the crypto ecosystem will soon be entering society at large. The governmental CBDCs will likely provide nothing more than an actual paper currency, except maybe the security of using blockchain tech.

Once a critical mass of users is achieved, CBDCs may be able to co-exist, but the benefits of using crypto, which I outline in different articles of mine, far outweigh any government-sponsored digital currency.

Crypto is in and of itself a people’s currency. Neither governments nor private authorities can regulate it — it’s a pure Adam Smith-ian dream. We, and that includes you, need to be the ones who adopt it of our own accord and for our own sake.

In this case, progress won’t come from governments. Governmental acceptance of crypto will not be the catalyst to large-scale adoption. It shouldn’t even be a milestone or sub-goal.

A governmental ban? It does nothing but tell me cryptocurrency is a powerful threat and an imminent future.